24-01-2024

24-01-2024

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.5 - 33 votes

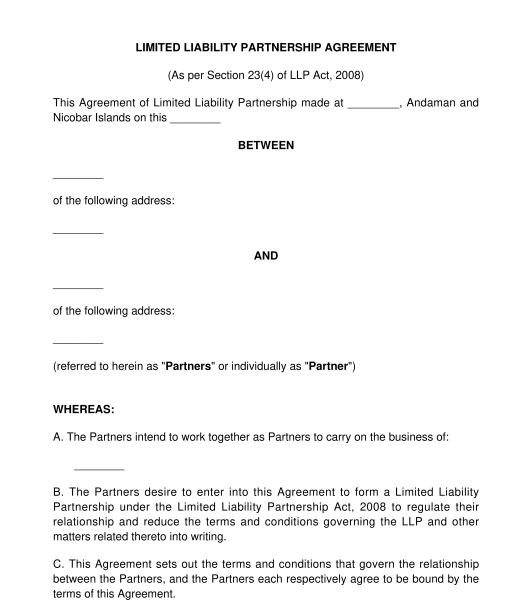

Fill out the templateAn LLP Agreement is an agreement between two or more individuals or businesses who would like to manage and operate a business together in order to make a profit.

A Limited Liability Partnership i.e. LLP is an alternative corporate business form that gives the benefits of limited liability of a company and the flexibility of a partnership. In an LLP, several partners are able to work together (unlike a sole proprietor). However, the LLP is a separate legal entity, is liable to the full extent of its assets, but the liability of the partners is limited to their agreed contribution in the LLP, unlike a partnership which is not a separate entity from the partners and is documented through a Partnership Deed. If the partnership incurs a liability, the partners are personally responsible for it.

The LLP can continue its existence irrespective of changes in partners. It is capable of entering into contracts and holding property in its own name. Further, no partner is liable on account of the independent or unauthorised actions of other partners, thus individual partners are shielded from joint liability created by another partner's wrongful business decisions or misconduct.

Mutual rights and duties of the partners within an LLP are governed by an agreement between the partners or between the partners and the LLP, as the case may be. The LLP, however, is not relieved of the liability for its other obligations as a separate entity.

The LLP Agreement describes the mutual rights and duties of partners inter se and those of the LLP. It also outlines the ownership interest in the LLP, defines the profit and loss distribution of each partner, prepares the LLP for common business scenarios, and includes other important rules about how the LLP will be managed and conduct business.

As per the provisions of the LLP Act, 2008 in the absence of agreement as to any matter, the mutual rights and liabilities shall be as provided for under Schedule I to the Act. Therefore, in case any LLP proposes to exclude provisions/requirements of Schedule I to the Act, it would have to enter into an LLP Agreement, specifically excluding the applicability of any or all paragraphs of Schedule I.

The document is a critical foundational document for running a new business and sets the business up for success by ensuring clear communication and defined responsibilities for all the partners. This Agreement documents both contingency plans for when things go wrong, as well as descriptions of the LLP's day-to-day operations. An LLP Agreement provides some protection to the partners involved in the business and is becoming a popular means of entering into a business venture.

How to use this document?

An LLP Agreement can be created either as a first step to outline partner expectations and responsibilities before the partners begin doing business together and set up the LLP. The LLP Agreement will cover the following matters:

Once the LLP Agreement is completed, all the partners should sign and date the LLP Agreement. Each partner's signature should be witnessed by an independent adult, meaning somebody over 18 years old, who is not involved with the LLP. This means the partners cannot witness each other.

The partners should keep copies of the LLP Agreement for their records. If the partners wish to change any of the terms of the Agreement, they should be sure to do so in writing.

Applicable Law

The LLP Act, 2008 is the law governing limited liability partnerships in India.

General principles of contract law, as provided by common law, may also apply.

How to modify the template?

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Other names for the document:

LLP Agreement, Limited liability partnership agreement, Articles of limited liability partnership, Business limited liability partnership Contract, Creation of limited liability partnership Agreement

Country: India