01/01/2024

01/01/2024

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.1 - 11 votes

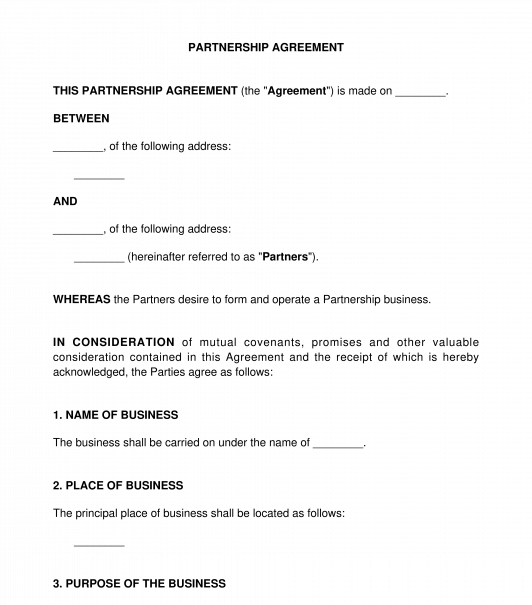

Fill out the templateA Partnership Agreement, also known as a Partnership Contract, is a written agreement between two or more individuals who intend to form and carry on a business (known as partnership) for the purpose of making profit.

This document is a crucial foundation document for running a new business. The Agreement protects all the Partners involved in the business as it outlines the nature of the business, the money contributed by each partner and the rights and responsibility of the partners, etc. In Nigeria, a Partnership is registered as a business name at the Corporate Affairs Commission.

There are two types of Partnership existing in Nigeria namely: the General Partnership and the Limited Liability Partnership. In a Limited Liability Partnership, the liability of all the partners is limited and they are not personally liable for debts incurred by the Partnership business. In General Partnership, all the partners are jointly and severally liable for all the debts incurred by the business and their liability also extends to both existing and previous partners of the business.

How to use this document

A Partnership Agreement can be created as a first step to outline the Partners' responsibilities before the Partners start doing business together or after they have started doing the business already. In this document, the form filler must fill the following information:

After filling this document, all the Partners must sign the document and each Partner must give a person to witness the document. The witness who must be at least 18 years old, is required to hand fill the necessary information required and sign the document. All the Partners must have different witnesses.

After the document has been duly signed, every Partner must keep at least one copy each for record purposes.

Applicable laws

The Companies and Allied Matters Act is applicable to this agreement as it relates to the registration of Partnership business and provides for the requirements for registration. According to the Act, the maximum number of Partners a Partnership can have is 20 (twenty), except law firms and accounting firms. What this means is that, every Partnership business other than a law firm and accounting firm must not have more than 20 (twenty) Partners.

Also, the Partnership laws at both Federal and State levels are applicable to this Agreement.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Choose the Best Legal Structure for your Business

Other names for the document:

Articles of Partnership, Business Partnership Agreement, Creation of Partnership Agreement, Formation of Partnership Agreement, General Partnership Agreement

Country: Nigeria