09/01/2024

09/01/2024

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.3 - 2 votes

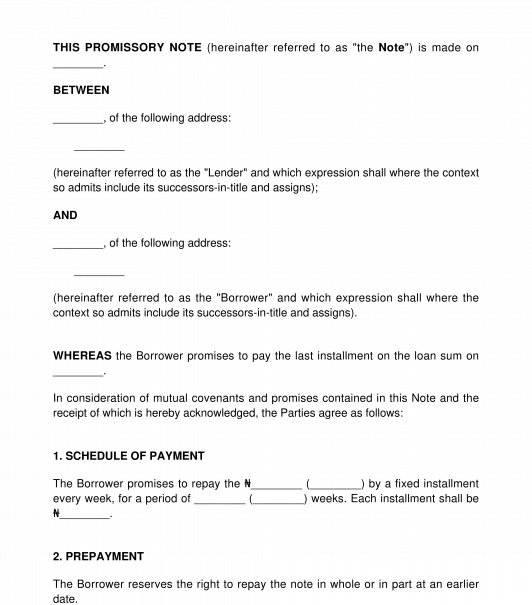

Fill out the templateThe Promissory note is a written promise to repay a debt to the lender or creditor, under agreed terms and conditions. The debtor uses this document to show that the debtor is committed to paying back their debt, either at a particular time or upon the demand of the lender.

The note is a debt instrument issued to the lender that shows a debtor's indebtedness. It contains all the terms relating to the debt, such as the principal amount, interest rate, the date of repayment, the security (if any), etc.

The promissory note is similar to the Loan Agreement. However, the loan agreement is more complex and detailed than the former as it outlines the specific obligations of the parties involved in the transactions. The promissory is a simple document that is used to record a promise to pay back money and can be used in less complex contractual relationships.

How to use the document

This document can be used for short-term financing. For example, when a company buys many products from its creditors, it may issue a promissory note to the creditors and pay the price for the products at a later date. Also, a party may collect a loan from the bank and issue a promissory note to the bank.

After completing the document, it should be printed and signed by both parties. If any of the parties is an individual, the party should sign the document, and at least one witness should attest to it. But if either of the parties is a company, the company seal may be affixed on the document, and either two directors or one director and one company secretary should sign the document.

After this, both parties should keep a signed copy of this document for their record. The lender(s) must return the promissory note to the borrower(s) once the issuer repays the loan or the money owed.

Applicable laws

The note is a bill of exchange, so the Bill of Exchange Act is the applicable law.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Recover Money from a Debtor

Other names for the document:

Borrower Note, Debt Note, IOU, Payment on Arrival, Payment on Demand

Country: Nigeria