02/11/2025

02/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

02/11/2025

02/11/2025

Word and PDF

Word and PDF

7 to 10 pages

7 to 10 pages

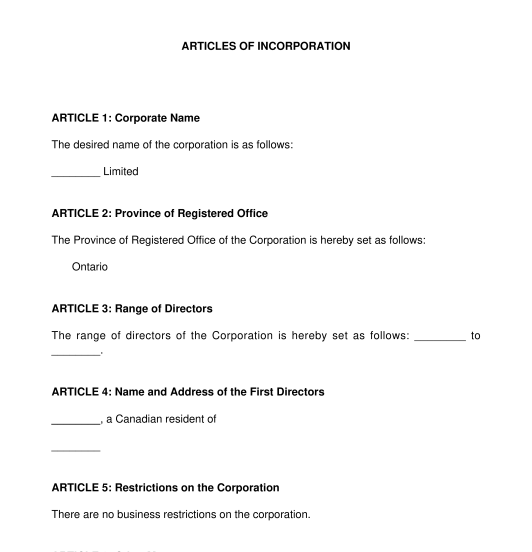

Articles of Incorporation (or Articles/ Memorandum of Association in Nova Scotia and Articles of Constitution in Quebec) are documents that create the corporation, and contain essential information that the government requires, including the corporation's name, the number of directors, and more.

Once the government approves the prescribed forms that the incorporator(s) have submitted, the government grants a certificate of incorporation, which represents the corporation's birth.

Yes. Having articles of incorporation is mandatory in order to create a corporation. Although the government will have its own official form, this document may be added to the government form when filing Articles of Incorporation. In some Provinces, incorporator(s) may add additional pages to the government forms because they run out of space to fill in a certain section, such as the share structure. If that is the case, this template may be used to add to the government's Articles of Incorporation form. Incorporator(s) may be required to enumerate the additional pages based on the requirements of the government form. Other jurisdictions may require a form labelled as "Schedule" to be attached to the government form.

Articles of Incorporation must contain the following:

The Articles of Incorporation last for the lifetime of the corporation. The articles can be amended by way of articles of amendment. The articles of incorporation will cease to exist only upon filing a dissolution or winding-up the corporation. In other words, the articles last for as long as the shareholders decide to keep the corporation alive.

Once the incorporator(s) have filled out the document, the incorporator(s) will be prepared to file the appropriate government forms with a complete share structure. Unlike the bylaws of a corporation, Articles of Incorporation are public record.

This document is NOT the official government form. The incorporator(s) will need to submit the government forms to the appropriate government branch. For example, for federal corporations, the appropriate branch is Corporations Canada (Innovation, Science and Economic Development Canada).

The purpose of this document is to provide an overall template on Articles of Incorporation and to provide a specific share structure that the incorporator(s) may use when it comes time to file the required government forms. Although this is accessible online, many forms do not contain helpful templates for share structures. It should be noted that certain Provinces will require additional forms to be filed on top of the form for Articles of Incorporation, and this is different for each Province.

Once approved, the government will grant a certificate of incorporation.

There aren't technically owners of a corporation. Legally speaking, a person does not own a corporation, given that a corporation is considered a person in the eyes of the law. Rather, individuals own shares in a corporation, which represents an interest the individuals have. Shares have been legally defined as a bundle of rights. Therefore, a person has rights in a corporation through shares. Once an individual has shares in a corporation, they become shareholders.

Once incorporated, the shareholder(s) are protected. With certain exceptions, this means that the shareholder(s) of the corporation will not be found personally liable for the corporation.

The corporation and the incorporator(s) are not the same entity. A lawsuit against a corporation will not expose the personal property of the shareholder(s), and the debts of the corporation belong to the corporation, not the shareholder(s).

This also means that the property of the corporation does not belong to the shareholder(s).

Since a corporation is distinct from the shareholder(s), the corporation also pays taxes separately and files its own income tax return.

Corporate law is governed by federal law, Provincial legislation and case law. Corporate legislation covers the process of incorporation. The applicable statute depends on where the incorporation took place. The pieces of legislation governing Articles of Incorporation are as follows:

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Articles of Incorporation - Template - Word & PDF

Country: Canada (English)