06-11-2025

06-11-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

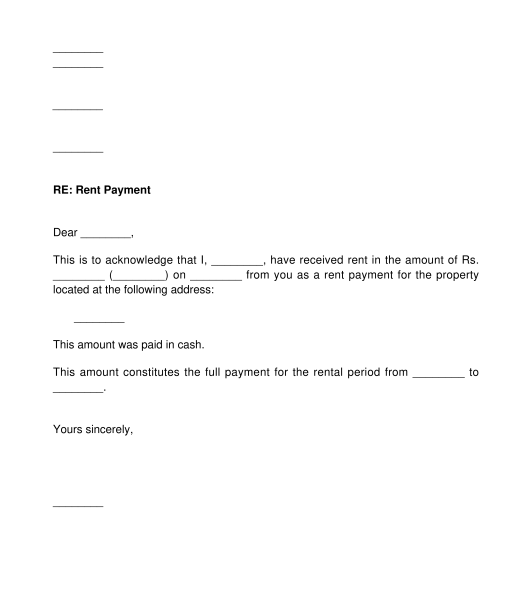

A Rent Receipt is a way to document rent payments that a Tenant (who is using the rented property) makes to a Landlord (who has rented the property). Rent Receipts give Tenants evidence that they have submitted payments to the Landlord as required.

For tenants who pay their rent in cash, a rent receipt is often the only written proof they have to show that they paid rent. Both landlords and tenants often choose to keep copies of rent receipts for this reason. In case of a dispute, the parties can submit these receipts in court as proof of payment.

This Receipt also allows the Landlord to confirm whether the payment was full or partial. If the Tenant made a partial rent payment, the Landlord can describe any late charges that the Tenant may then be required to pay in relation to any remaining payment that is overdue.

The rent receipt can be used for:

Yes, it is mandatory to issue a Rent Receipt if the tenant asks for the same. To get tax benefits, a copy of the original Rent Receipt is required, including the deduction of the rent as an expense of business and input tax under the GST.

A Rent Receipt can be issued by the landlord or property owner who receives the payment or, the property manager or authorized representative acting on behalf of the landlord.

Once the Rent Receipt has been filled out, the Landlord can send an original signed copy of the receipt to the Tenant and save a copy for their records.

The Rent Receipt can be sent to the tenant as a physical copy or digital copy via email or other digital means.

Landlords are obligated to issue a Rent Receipt upon receipt of payment especially when the tenant requests for the same. If the landlord refuses, the tenant can send a written request asking for the Rent Receipt.

If the landlord refuses to provide the Rent Receipt after sending the written request, the tenant can file a complaint before the Rent Control Court or other concerned courts in the locality where the property is located.

A Rent Receipt should contain the following key elements:

In some cases, a rent receipt may be required for claiming tax deductions towards house rent allowance under the Income Tax Act, 1961.

Further, the Indian Stamp Act, 1899 requires a receipt to be given on demand and also requires that a revenue stamp be affixed on receipts over an amount of Rs. 5000 (Rupees Five Thousand).

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Rent Receipt - Template, online sample - Word & PDF

Country: India