11/21/2025

11/21/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

11/21/2025

11/21/2025

Word and PDF

Word and PDF

1 page

1 page

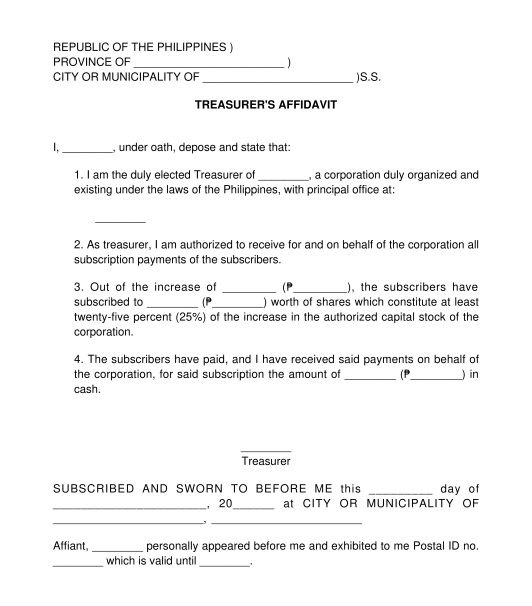

A Treasurer's Affidavit or a Treasurer's Certificate is a document that is subscribed and sworn to by the Treasurer of a corporation to certify the amounts subscribed and paid by the subscribers for stock corporations. It is one of the requirements for the increase of the authorized capital stock for stock corporations.

It is mandatory to have a Treasurer's Affidavit to establish the following:

Subscribed stock pertains to shares of stock that investors or prospective stockholders have committed to purchase but have not yet been issued by the corporation, while paid stock pertains to those already paid by the shareholders and have already been issued by the corporation.

A Treasurer's Affidavit contains the following information:

It is the Treasurer who signs a Treasurer's Affidavit to certify certain matters involving the finances of the corporation. The Treasurer is an officer of the corporation in charge of the management of the financial affairs of the corporation.

Once the Treasurer's Affidavit is completed, at least 3 original copies of the document should be printed. The Treasurer's Affidavit should present himself to a notary public where he will swear to the truth of the contents of the Treasurer's Affidavit and sign the document in front of the notary public. The notary public will then affix their seal and signature on the document.

The notary public will usually keep one original copy of the document. Then the Treasurer should keep at least one original copy for the records of the corporation. Lastly, one original copy may be submitted to the Securities and Exchange Commission to approve certain acts (i.e. increase of the authorized capital stock)

Yes. The statements in a Treasurer's Affidavit are in effect, making a sworn statement. Sworn statements should be executed or signed in the presence of a notary public.

In order for the Securities and Exchange Commission to approve certain acts by the corporation such as the increase or decrease of the authorized capital stock, a Treasurer's Affidavit should be submitted to the Securities and Exchange Commission.

Notarization fees for a Treasurer's Affidavit are typically PHP100 to PHP500.

Laws relating to Corporations are governed by the Revised Corporation Code of the Philippines. However, other laws, such as but not limited to the 1987 Constitution of the Republic of the Philippines, the Foreign Investments Act, specifically the Foreign Investment Negative List, and the Anti-Dummy Law, may affect the ownership and board membership requirements of a corporation, depending on the business of the corporation.

Affidavits are governed by the 2004 Rules on Notarial Practice. It should also be noted that making untruthful statements in a notarized affidavit may be punishable under the Revised Penal Code of the Philippines.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Treasurer's Affidavit - sample template - Word and PDF

Country: Philippines