27/11/2025

27/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.6 - 392 votes

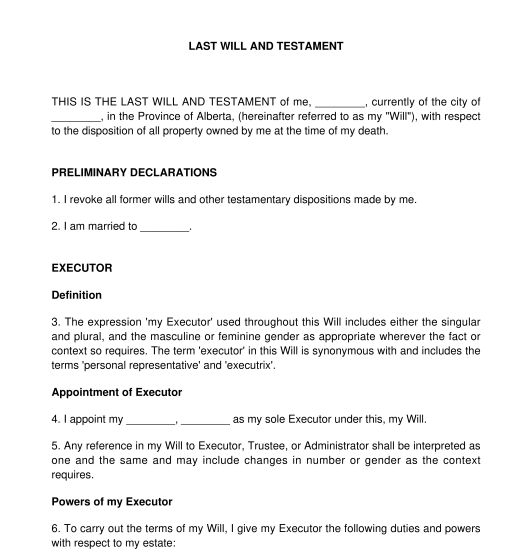

Fill out the templateA Will is a legal document that sets forth the wishes of a person (the testator) after death. The Will gives directions regarding the distribution of property and the care of minor children, if any, after death, and is the centerpiece of an estate plan. A Will is meant to ensure that the wishes of the deceased are followed.

No. Having a Last Will and Testament is not a legal requirement. However, having a Last Will and Testament is important because it prevents the government from deciding how a deceased person's property will be distributed. The government's decision on how and where property will be distributed is based on the Provincial or Territorial laws where the deceased held assets. Not having a Will in place increases frustration and complexity for those taking care of the estate.

A Will must at least contain a clause appointing an executor and a clause dealing with the property of the testator, including a residue clause. A Will must clearly show the deceased's intention with respect to their property.

The appointment of an executor means choosing an individual to look after the deceased's estate, including paying all debts, advertising to creditors, and distirbuting the deceased's property. The residue clause is the part of the Will that disposes of what remains of the deceased's property after all debts have been paid and after all specific gifts have been distributed.

In most jurisdictions, the testator must be at least 18 years old to make a Last Will and Testament. In addition, the testator must be of "sound mind" to make a Last Will and Testament, which means that:

For a Will to be valid, it must be signed by the testator and two witnesses at the same time in the presence of each other.

The witnesses must not benefit under the Will.

After the Will is witnessed, one of the witnesses must sign an Affidavit of Execution. A witness can be anyone other than a beneficiary under the Will or the beneficiary's spouse.

The affidavit must be signed in front of a commissioner of oaths and affidavits. A commissioner is a person appointed by the government to certify affidavits. A commissioner also includes a lawyer or a paralegal.

An Affidavit of Execution should also be attached to the Last Will and Testament. The Affidavit is not mandatory, but the importance of the Affidavit should not be overlooked.

The Affidavit serves as evidence that the Last Will and Testament was properly signed before two witnesses and that the testator had knowledge and approval of their Last Will and Testament.

No. The Last Will and Testament does not need to be registered.

The testator may choose to register their Will online in a registry system for an additional fee (around $40).

The registration allows an executor to locate the deceased's will because it contains specific instructions, such as the code to a safe.

Yes. For the Last Will and Testament to be valid, it must be witnessed before two witnesses.

A witness can be anyone other than a beneficiary under the Will or the beneficiary's spouse.

If the witnesses to the Last Will and Testament have signed an affidavit of execution, it needs to be commissioned by a commissioner, which will be an added fee. The amount of the fee depends on the individual commissioner's rate (around $50-$300).

A Will should be reviewed from time to time to ensure that it still meets the needs of the testator and that the property will be distributed according to his or her wishes. It is especially important to review a Will on the following events:

In Canada, wills, testamentary succession and estate law is a provincial or territorial matter. There are many different laws in each jurisdiction that govern Wills, trusts, executor powers and compensation, and so forth. The following are the primary statutes governing Wills:

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Last Will and Testament - Template - Word & PDF

Country: Canada (English)