03-11-2025

03-11-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

03-11-2025

03-11-2025

Word and PDF

Word and PDF

5 to 8 pages

5 to 8 pages

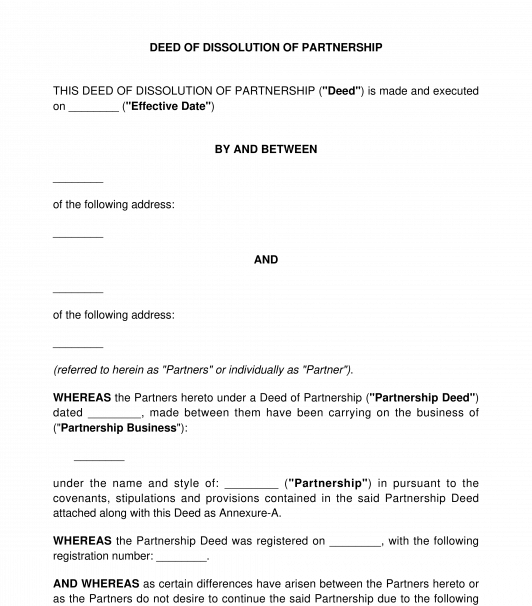

A Deed of Dissolution of Partnership Firm ("Deed") is a legal document that formally terminates the existence of a partnership firm. The Deed generally covers the terms and conditions agreed upon by all Partners regarding the dissolution of the partnership.

The partnership dissolution can be initiated on several occasions:

The initial step towards the dissolution is settling all legal and financial obligations of the partnership. This includes pending cases, debts, loans, etc.

Once the liabilities are settled, the remaining assets or profits, if any, can be distributed among the partners in the agreed proportion.

The Deed covers the following major clauses:

The dissolution of the firm is only possible when all partners or such a number of partners as mentioned in the Partnership Deed approve and sign this Deed.

Once prepared, the Deed shall be stamped as per the state laws where the partnership is located. It is better to get the Deed notarized to avoid any disputes in the future.

If the partnership is registered, the information regarding dissolution shall be communicated to the concerned registrar within 90 days from the date of dissolution (i.e. from the date of signing this Deed).

Major provisions under this Deed will be covered under the Indian Partnership Act, 1932 and the Indian Contract Act, 1872.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Deed of Dissolution of Partnership Firm - Template

Country: India