15-11-2025

15-11-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.5 - 101 votes

Fill out the templateA Partnership Agreement is an agreement between two or more individuals who would like to manage and operate a business together in a form of a partnership in order to make a profit. It is a common business structure in India and can be contrasted to other common business structures such as a sole proprietor, an LLP, a company, or a trust.

In a partnership, several partners are able to work together (unlike a sole proprietor). Each partner shares a portion of the partnership's profits and losses, and each partner is personally liable for the debts and obligations of the partnership.

Compared to a company or a trust, a partnership can have lower setup and administration costs. However, while companies and trusts offer some protections against liability, a partnership does not. A partnership is not a separate entity from the partners. If the partnership incurs a liability, the partners are personally responsible for it. Furthermore, a partner can become liable for debts that another partner has incurred on behalf of the partnership.

A Limited Liability Partnership (LLP) is a distinct form of business that offers the advantages of limited liability, similar to a corporation, while also providing the flexibility of a partnership. The Limited Liability Partnership (LLP) is treated as a distinct legal entity from its partners. In the event of any disputes and liabilities or penalties that may arise in the future – for example, if a third party claims damages due to a business transaction failure – the damages will be limited to the total capital of the LLP.

The partners' liability is restricted to their agreed contribution to the LLP. It's important to note that the Limited Liability Partnership (LLP) Agreement differs from the partnership deed used for traditional partnerships.

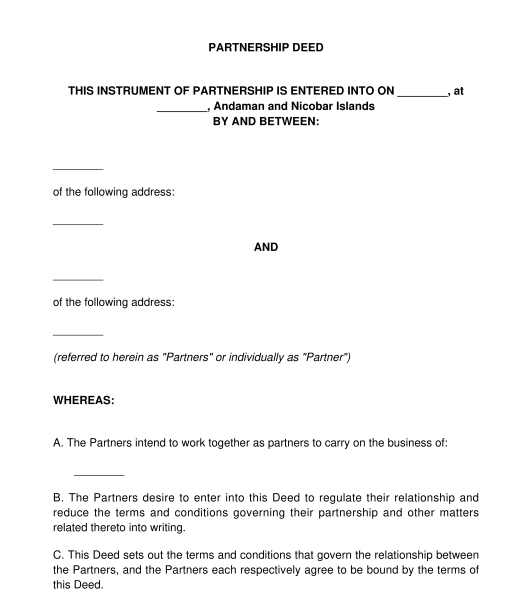

Yes, in India, a written Partnership Deed is mandatory for registering a partnership. The partnership firm is registered under the Registrar of Firms, which is located in each state in India.

Partnership Deed can be entered into by any two individuals who are above the age of 18, possess a sound state of mind, and are not prohibited by law from forming a contract.

There is no specified period for a Partnership Deed. The period will be as mentioned under the Partnership Deed such as for a fixed period, a period till the completion of a certain project, or for an indefinite period.

Once the Partnership Deed is completed, it needs to be printed on a non-judicial stamp paper. The stamp duty varies from state to state. The information can be found on the websites of the revenue departments of the concerned states.

All the partners should sign and date the Partnership Deed. Each partner's signature should be witnessed by an independent adult, meaning somebody over 18 years old, who is not involved with the partnership. This means the partners cannot witness each other, and people closely connected to the partners (such as their respective spouses) should not act as witnesses either.

The partners should keep copies of the Partnership Deed for their records. If the partners wish to change any of the terms of the Agreement, they should be sure to do so in writing.

No, it is not mandatory to register the Partnership Deed; however, legal protection for partnerships in disputes between partners can only be availed once the partnership is registered.

A Partnership Deed typically includes the following key clauses:

The Indian Partnership Act, 1932 is the law governing partnerships in India. General principles of the Indian Contract Act, 1872, as provided by common law, may also apply.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Partnership Deed - Sample, template - Word & PDF

Country: India