12-11-2025

12-11-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

12-11-2025

12-11-2025

Word and PDF

Word and PDF

9 to 13 pages

9 to 13 pages

This Sub-Lease Agreement for Commercial Property can be used when a commercial property is being subleased by an existing tenant (Sub Lessor) to another tenant (Sub Lessee) in part or in full.

A tenant can use this Agreement to Sublet the property with the permission of the Lessor/Property Owner to other parties. Sometimes, some space in the leased premises may be vacant, or the intended project may be delayed for some time. During such situations, the Tenant can Sublease such vacant portion of the whole property for a specific period to monetize such gap. This Sublease will create a legally binding contract between the parties, outlining the rights and responsibilities of both the Sub Lessor and Sub Lessee.

This document is intended for the sublease of commercial properties only, including offices, warehouses, shops and so on. It cannot be used for residential property such as apartments, houses and so on.

This Sublease agreement is different from that of the Commercial Lease Agreement. Under the Lease Agreement, the transaction is between the Lessor/Property Owner and a tenant. On the other hand, under the Sublease Agreement, an existing tenant sublets the leased property to another party as a Sub-Tenant or Sub Lessee in accordance with the original lease deed.

No, it is not mandatory to have a Sub-Lease Agreement for Commercial Property. However, having one will help both parties to have a clear understanding and avoid any disputes in future.

In most cases, before subleasing property, the written consent of the Lessor/Property Owner may be required. To find out such consent requirements, the parties shall refer to the original commercial lease deed.

After checking the original commercial lease deed, the sublessor shall ensure that the duration of the Sub-Lease Agreement for Commercial Property does not exceed the duration of the original commercial lease deed. Moroever, the parties shall ensure that the clauses in the Sub-Lease Agreement for Commercial Property do not contradict or violate the terms of the original commercial lease deed.

Any individuals above the age of 18 years or entities registered in India can enter into a Sub-Lease Agreement for Commercial Property.

The duration of the Sub-Lease Agreement for Commercial Property can be decided by the parties and it varies from a few months to a few years. The durations shall not exceed the term of the original lease.

The Sub-Lease Agreement for Commercial Property would need to be printed on non-judicial stamp paper or e-stamp paper, which is available in certain states. The value of the stamp paper would depend on the state in which it is executed, as well as the duration of the lease and the lease rent. Each state in India has provisions in respect of the amount of stamp duty payable on the lease deed, and the same would need to be determined based on the specific facts of the case. Information regarding the stamp duty payable can be found on the State government websites.

After printing the document on stamp paper or e-stamp paper, as applicable, both parties should sign the lease deed and each party should keep a copy of the lease deed.

The following documents can be be attached to a Sub-Lease Agreement for Commercial Property:

Yes, the Sub-Lease Agreement for Commercial Property needs to be registered if the period of the lease is more than one year. For registration, both the sub-lessor and sub-lessee have to go to the concerned office of the sub-registrar where the property is located.

Yes, two witnesses over the age of 18 years are required to register a Sub-Lease Agreement for Commercial Property. Even if registration is not completed, having two witnesses will aid in resolving disputes easily.

This Sub-Lease Agreement for Commercial Property must contain the following clauses:

In terms of the Transfer of Property Act, 1882 read with the Registration Act, 1908 all leases for terms of more than one year are compulsorily registrable. However, leases for a duration of one year or less do not need to be registered with the Sub-registrar.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

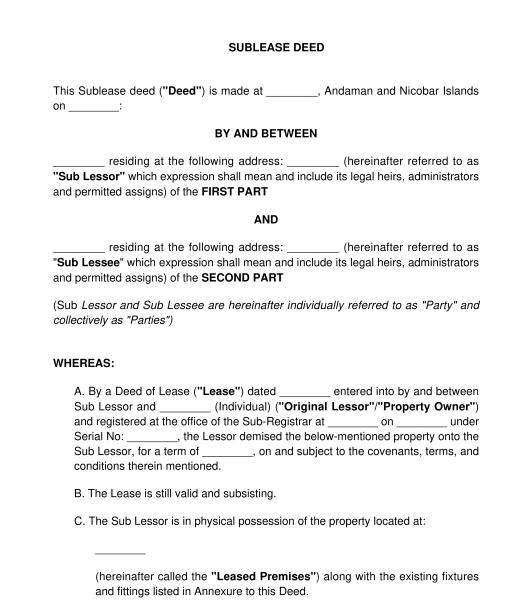

Sub-Lease Agreement for Commercial Property - Template

Country: India