04-11-2025

04-11-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

04-11-2025

04-11-2025

Word and PDF

Word and PDF

1 to 2 pages

1 to 2 pages

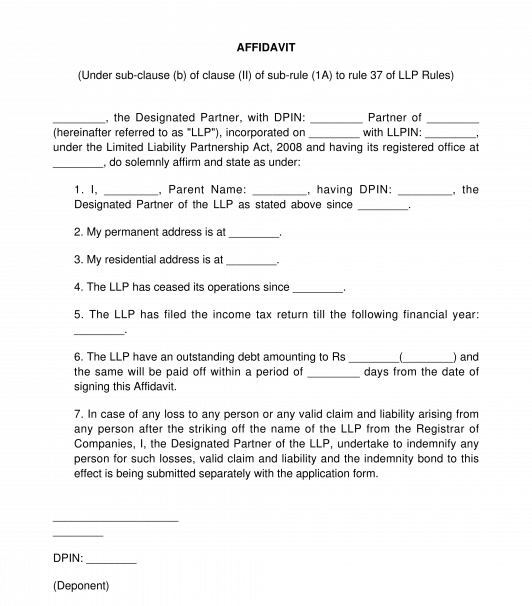

An Affidavit of Designated Partners to Wind Up an LLP is a document used under the LLP (Winding up and Dissolution) Rules, 2010 to wind up an LLP. All the Designated Partners or the majority of them (not less than two) are required to sign this Affidavit and submit it to the concerned Registrar of Companies (RoC).

This document can be either created separately for each Designated Partner or as a single document for all the Designated Partners signing the affidavit.

A designated Partner is an individual partner of the LLP appointed by other partners to act on behalf of the LLP in accordance with the rules as envisaged under the LLP Agreement. A Designated Partner is like a director in a company.

Under this Affidavit, all the Designated Partners are affirming that the LLP is in compliance with the LLP (Winding up and Dissolution) Rules, 2010 and taking responsibility for any liability arising after the dissolution of the LLP.

This document can be used for voluntary winding up by any type of LLP registered under the LLP Act, 2008.

This document includes the following major areas:

Once prepared the affidavit needs to be signed by all named Designated Partners and shall be submitted to the concerned Registrar of Companies (RoC) within 15 days from the date of passing a Special Resolution of Partners to Wind up an LLP.

The LLP Act 2008 along with LLP (Winding up and Dissolution) Rules, 2010 will be applicable here.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: What to Consider when Winding up an LLP in India?

Country: India