25/11/2025

25/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

25/11/2025

25/11/2025

Word and PDF

Word and PDF

1 page

1 page

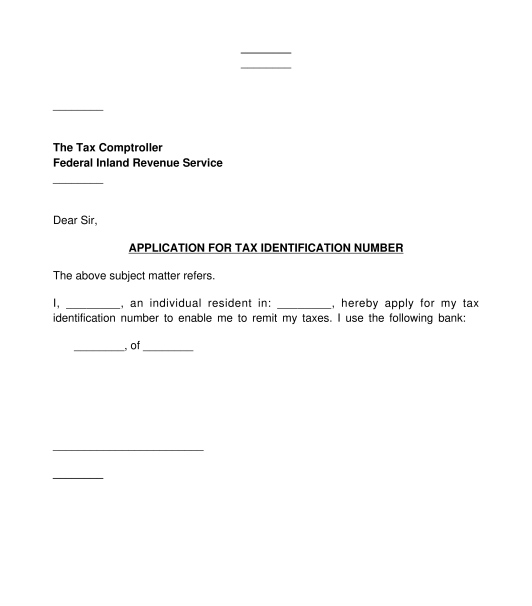

A TIN application letter is a document an individual or business can send to the Federal Inland Revenue Service (FIRS), requesting to be registered to remit their taxes.

Tax registration is a legal obligation for everyone in Nigeria regardless of whether the individual or organization is required to pay tax or exempted from tax. Hence, every Nigerian individual and organization in Nigeria must be registered.

The TIN (Tax Identification Number) is a unique ten-digit ID number that is issued to a party after registration.

When a party obtains a TIN, it shows that the individual or organization is a registered taxpayer in Nigeria. Upon registration, the individual, business, or organization receives a TIN, which allows them to remit taxes in Nigeria.

Yes, it is mandatory to apply for a TIN for all taxpayers, including individuals and businesses.

For more information about obtaining a TIN, please refer to the legal guide on "How to Obtain a Tax Identification Number."

For individuals, the following details are required in the TIN application letter:

For companies, business names and incorporated trustees, the following details are required in the TIN application letter:

Before applying for TIN, individual applicants must have a valid means of identification, a valid residential address, and must be legally allowed to work in Nigeria.

On the other hand, Nigerian businesses and registered organizations must be registered with the Corporate Affairs Commission (CAC), and have their business registration documents including the Memorandum and Articles of Association.

The TIN application letter should be printed and signed by the applicant. The TIN application letter can also be electronically signed and printed.

After signing, the TIN application letter should be sent to the nearest FIRS office.

Note: The FIRS has several locations in several parts of Nigeria. The applicant can submit their TIN application at any FIRS office.

This TIN application letter should be sent to the requisite FIRS office along with the following documents:

For more information about obtaining a TIN, please refer to the legal guide on "How to Obtain a Tax Identification Number."

No, TIN application letters are not notarized in Nigeria.

No, it is not necessary to have witnesses for TIN application letters.

Obtaining a TIN in Nigeria is free unless the applicant chooses to hire an attorney or third party to apply on their behalf. In that case, the applicant might incur costs for the services of the third party.

Ordinarily, the TIN should be issued the same day the application is submitted, unless the applicant is required to provide additional information or complete additional steps.

The Finance Act, 2020 makes it compulsory for every person intending to operate a business bank account to obtain their TIN.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Country: Nigeria