19/11/2025

19/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

19/11/2025

19/11/2025

Word and PDF

Word and PDF

1 page

1 page

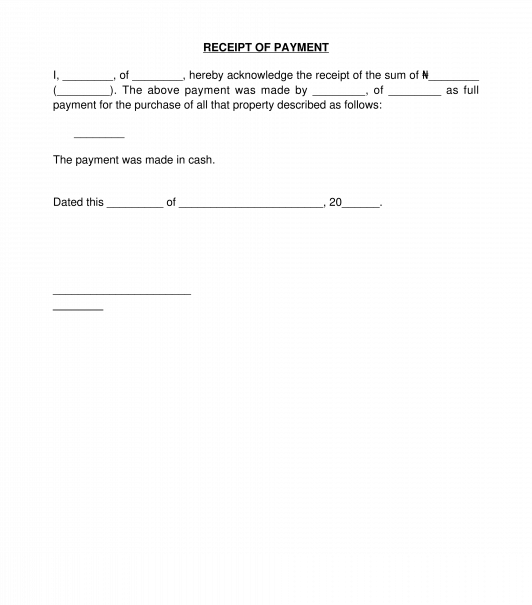

The Receipt of Purchase of Real Property is a document that acknowledges that a person has received payment for land or building. Following the sale of real property, the purchaser makes either part payment or full payment to the owner of the property or the manager of the property (the vendor), and the vendor delivers this receipt of purchase to the purchaser.

This document is used in real estate transactions and can serve as proof of the transfer of real property from the vendor to the purchaser. Other important documents required for a real estate sale and purchase are the Contract for the Sale of Real Property and the Deed of Assignment.

Overall, whenever money is paid for the purchase of any real, this document should be issued as it shows that the interest in the property has been sold and transferred to the party that made the payment. The Rent Receipt and General Receipt are also available for download.

How to use this document

In this document, the form filler will enter the full name and address of the party issuing the receipt, the full name, and address of the party that made the payment, the description of the land or building that was sold, the amount paid and balance (if any), and the date of payment.

After completing the form, the receipt should be printed and signed by the party issuing the receipt. The signed copy should be delivered to the party who made the payment. Also, a copy of this receipt should be kept for record purposes.

Applicable law

If the recipient is legally required to collect sales tax or VAT from a customer or client, the amount must be added to the receipt and the collection will be made on to the relevant tax authority. The Value Added Tax (Amendment) Act and other relevant tax laws are applicable to this document.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Receipt of Purchase of Real Property - FREE - template

Country: Nigeria