09/10/2025

09/10/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

09/10/2025

09/10/2025

Word and PDF

Word and PDF

10 to 15 pages

10 to 15 pages

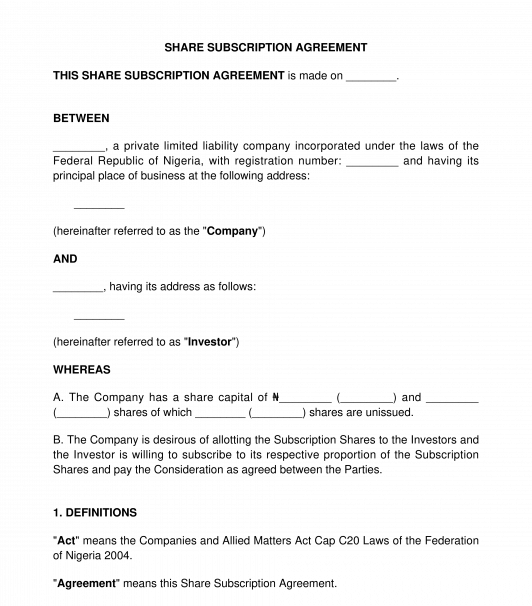

A Share Subscription Agreement is an agreement between a company and investors to sell shares to the investors at a fixed price. This is simply done by offering new shares to investors, who after the closing of the transaction, become shareholders of the company. If a company wants to raise capital, it can do so by issuing shares that can be purchased by private placement or public offer.

What distinguishes this document from a Share Sale and Purchase Agreement is that in the case of share subscription, the company itself is the party selling new shares, while in share sale, a shareholder of the company is selling an already issued shares to another party.

Shares are fixed identifiable units of capital that represents a member's stake in a company. Once a person holds shares in a company such party becomes a member of the company with the right to transfer and transmit the shares. The various classes of shares that can be offered by a company are: ordinary shares, preference shares, deferred ordinary shares, cumulative preference shares, redeemable preference shares, etc.

The companies that can issue and allot shares are as follows:

The document outlines the parties to the transaction, description of the shares being offered for sale, purchase price (consideration), warranties and representations of the parties, pre-completion and post-completion requirements, etc.

How to use this document

This document is used by companies to raise capital from investors.

After completing the document, the parties to the agreement must sign the document. If the agreement involves the sale of shares by the issuing company, the common seal of the company must be affixed on the document and at least two directors or one director and one secretary must sign the document on behalf of the issuing company.

The investor(s) must also sign the document. If the investor(s) is a company, the common seal of the company must be affixed on the document and at least two directors or one director and one secretary must sign the document on behalf of the investor(s). If the investor(s) is an organization other than a company, an authorized representative of the organization must sign the document.

Once all the parties to the agreement have duly sign the document, the parties are expected to keep at least one original signed copy of the document for record purposes.

After this is done, the company must file the following document at the Corporate Affairs Commission to reflect the allotment of shares to the investor(s):

After the post incorporation filing is done, the company must take steps to ensure that the name of the investor(s) is entered in the register of members of the company (if the investor is not already a member of the company).

Applicable law

The Companies and Allied Matters Act, 2020 apply to this document. Also, the Investment and Securities Act and the Securities and Exchange Commission (SEC) Rules applies to the allotment of the shares of a public company. The general rules of contract are also applicable to this document.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Choose the Best Legal Structure for your Business

Share Subscription Agreement - FREE - sample template

Country: Nigeria