20/11/2025

20/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

20/11/2025

20/11/2025

Word and PDF

Word and PDF

1 page

1 page

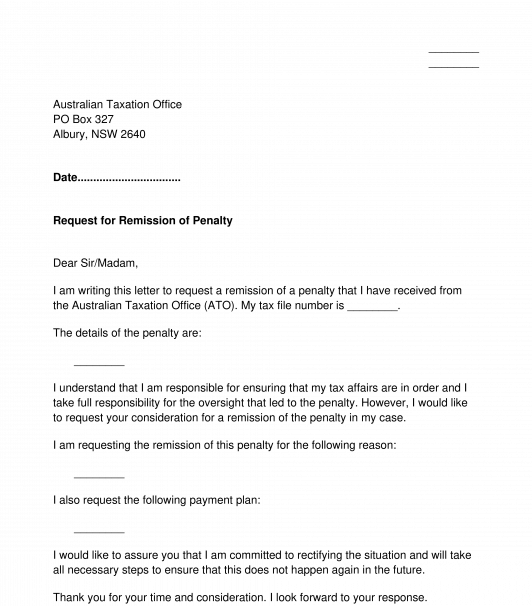

This letter may be sent to the Australian Taxation Office (ATO) to ask for a penalty to be waived (ie. to request remission of the penalty).

It is a basic letter containing the sender's (ie. the tax payer's) relevant details, as well as any details of the penalty that has been imposed by the ATO. The sender can provide a description of the penalty, and the reason it was imposed. They can also explain their own circumstances and the reasons they think it would be fair and reasonable for the penalty to be waived.

The letter helps the sender to present a professional, polite but compelling argument to the ATO about the penalty, and can help improve the chances that the penalty will be remitted.

To prepare this document, fill out all of the relevant information for the sender including full name and contact details. The sender of this letter cab be both individual and corporate taxpayer. Add their tax file number where prompted, as well as any relevant ATO reference number.

In the relevant section, add a clear explanation of the penalty including the date it was imposed and the reason it was imposed. Then where prompted, explain why it would be fair and reasonable for the penalty to be remitted. For example, if the sender has been experiencing financial difficulty, explain why this has occurred.

Once the letter has been completed, it can be printed and signed by the sender, and sent to the ATO.

If the sender needs any further information about the ATO's requirements, the ATO's website contains a lot of useful information.

Australia has the Income Tax Assessment Act 1936 (Commonwealth) and the Income Tax Assessment Act 1997 (Commonwealth), both of which apply to income tax matters in Australia.

The A New Tax System (Goods and Services Tax) Act 1999 (Commonwealth) applies to goods and services tax matters in Australia.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter

Country: Australia