12/11/2025

12/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

12/11/2025

12/11/2025

Word and PDF

Word and PDF

12 to 18 pages

12 to 18 pages

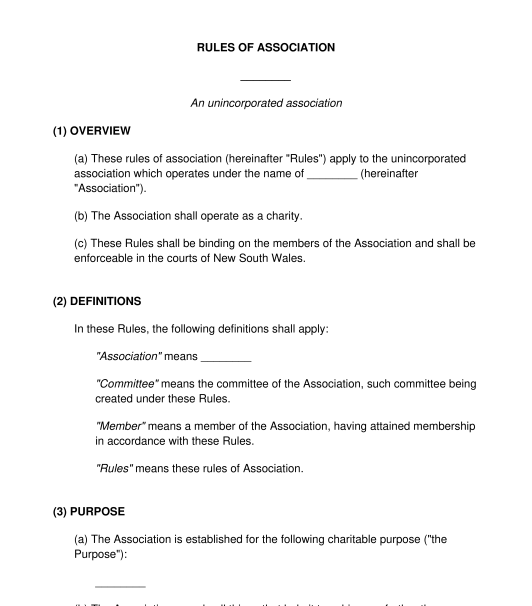

These Rules can be used as the governing rules for an unincorporated association. They set out a variety of guidelines, such as how the unincorporated association will operate, the purpose for which it will operate, how members can join the association, and how the association will make decisions.

In Australia, unincorporated associations are most commonly used for charitable purposes. However, they can also be used for other purposes, such as a community group to lobby the local government in relation to a particular issue, or for sporting teams.

These Rules are not designed for use with companies or other organisations that are not an unincorporated association.

No, it is not mandatory for an unincorporated association to have a written set of Rules. However, it is a good idea to have a set of Rules to help govern the association more effectively and to manage its affairs with transparency.

In addition, if the unincorporated association is being used for charitable purposes, then it is worth considering that there are additional legal obligations that the association must meet. Although it is not mandatory to have a set of written Rules in these circumstances either, a set of written Rules will help to ensure that the association complies with those legal obligations.

Quorum refers to the minimum number of members who need to be present for a valid meeting to be held. For example if the association has 20 members, and the Rules say that quorum for a members' meeting is 50% of the members, then this means that there must be at least 10 members present for a valid meeting. If only 9 members turn up, then the meeting will be invalid and any decisions made at the meeting will also be invalid.

A resolution is a decision which is made by the association, by have the members present at a meeting vote on it.

An ordinary resolution is generally a decision about less significant matters. A special resolution is a decision about more significant matters. For example, some associations might have a rule that spending of up to $1,000 can be approved by ordinary resolution, but any spending over $1,000 must be approved by special resolution.

The Rules will also say how many members need to be in agreement for an ordinary resolution and for a special resolution. For example, it might be the case that only 50% of members present at a meeting need to agree for an ordinary resolution to pass, but 75% need to agree for a special resolution to pass.

In some cases, once a first draft of these Rules has been prepared, it may work to provide the relevant people with a draft of the Rules so that they can make sure that they understand them.

Once the first members of the association are in agreement about the Rules and how the association will operate, then those first members should sign the Rules, and provide their names and addresses. The association should keep a copy of the signed Rules on file and should give a copy to each member.

If the association is going to operate as a charity, then there may be additional requirements for it to meet, including registering as a charity with the Australian Charities and Not-for-profits Commission.

No, the Rules do not need to be registered. The association should keep a copy of the signed Rules on file and should give a copy to each member.

These Rules should provide an outline of how the association will operate and should include information such as:

The rules form a contract between the members and therefore the principles of contract law as they relate to unincorporated associations will apply.

If the association holds assets then, as previously discussed, those assets will actually be held by the members of the association. If a member or several members hold an asset on behalf of the association, then according to law, those members may be considered to hold the asset on trust for other members of the association. In this case the principles of trusts law may also apply.

If the association operates as a charity, then charities law, including the Australian Charities and Not-for-profits Commission Act 2012 (Commonwealth) may also apply.

If the association collects personal information from members, then privacy law may also apply. This may but is not limited to) the Privacy Act 1988 (Commonwealth) and the Privacy Amendment (Enhancing Privacy Protection) Act 2012 (Commonwealth).

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Rules for an Unincorporated Association - template

Country: Australia