27/11/2025

27/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

27/11/2025

27/11/2025

Word and PDF

Word and PDF

8 to 10 pages

8 to 10 pages

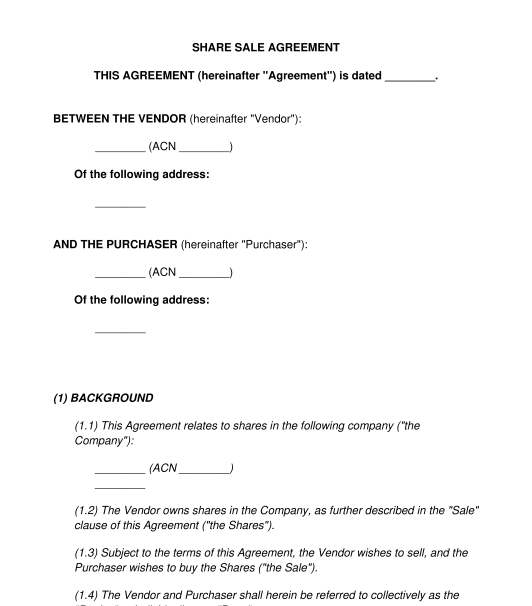

This Share Sale Agreement may be used when a shareholder wants to sell their shares in a private company to another person or entity. It provides a clear framework for the transaction, outlining the obligations and rights of both the seller and the buyer, and ensures that all necessary details are recorded in writing. This document is not designed for use with public companies.

This document is different from a Share Subscription Letter, although it has some similiarities. A Share Subscription Letter is often used when a company issues new shares to an investor. On the other hand, a Share Sale Agreement is typically used when existing shares are being sold by a current shareholder. The Agreement will detail any warranties and indemnities provided by the seller, providing assurance to the buyer about the shares and the company they are investing in.

This document is also different from a Business Sale Agreement which addresses a much wider scope of business transfer including assets, employees, leases, and intellectual property. For a better understanding of the differences, see our legal guide on How to Transfer Business Ownership.

When shareholders wish to sell their shares, it is important to have an effective and comprehensive Share Sale Agreement. This agreement not only maintains transparency between the seller and buyer, but also provides a clear record of the transaction, helping to avoid potential disputes or misunderstandings in the future.

The document specifies the seller who is selling the shares, and the buyer who is buying them. It lays out the number of shares being sold, the type of shares, the price per share, and the total amount the buyer will be paying for these shares.

Check the company's constitution and shareholder agreement to confirm whether any specific process needs to be followed in order to sell the shares. Some common processees that shareholder agreements require include pre-emptive rights (when existing shareholders have the first chance to buy new shares before the company offers them to an outside buyer), drag along rights (if a majority shareholder is selling their shares, they can force the minor shareholders to also sell their shares) and tag along rights (if a majority shareholder sells their shares, the minor shareholders can join the transaction and sell their shares on the same terms).

Fill in the document with the details of the seller (the person or entity selling the shares) and the buyer (the person or entity buying the shares), as well as the specifics of the transaction, such as the class of shares, price per share, and total transaction amount.

After preparation, the document should be signed and dated by both the seller and the buyer. Both parties should keep a copy for their records.

Following the completion of the share sale, there may be further mandatory steps for the company to undertake, such as updating the company's share register and notifying the Australian Securities and Investments Commission (ASIC) of the change in share ownership.

The Corporations Act 2001 (Commonwealth) applies to companies in Australia. This legislation and the general principles of contract law in Australia govern this Share Sale Agreement. If in doubt, seek legal advice.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Share Sale Agreement - sample template - Word and PDF

Country: Australia