07/11/2025

07/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.5 - 142 votes

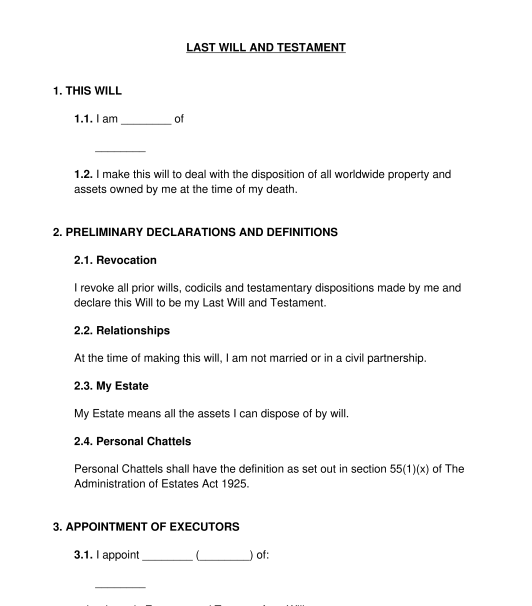

Fill out the templateA last will and testament (also known as a 'will') is a document that is used to set out a person's instructions about how they would like their assets and property to be distributed after they die. The person making a will is known as a testator. This last will and testament may be used by a testator who is living in England and Wales.

A will is used to set out how a person's finances and property will be distributed when they die.

A power of attorney will be used and referred to whilst a person is still living. A power of attorney grants authority to another person to act on behalf of the creator of the power of attorney during their lifetime.

No, it is not mandatory to have a will. Without a will, a person's assets will be distributed following the rules of intestacy. The rules of intestacy are a set of rules that will govern how a person's assets will be shared.

All assets and property owned by the testator at the time of their death are referred to collectively as their estate.

A beneficiary is a term for a party who will receive benefits or assets from the estate of the testator under the will after the testator dies. A beneficiary can be a family member, a friend or a charity.

An executor is the party that will be responsible for managing the estate of the testator after they die, by following the instructions in the will. It is possible to appoint more than one executor. An executor can be a:

An executor may not act if:

This will can be created by any person who is at least 18 years of age and a resident of England and Wales. The testator must have the legal and mental capacity* to make the will at the time of writing it.

In order to have the capacity to make a will, a testator must understand the nature and purpose of the will and the extent of the property that is being disposed of under the will. The testator must also be able to understand any legal claims which may arise under the will. The testator must not have any mental condition that prevents them from making the will.

A will takes effect when the testator dies. The executors have to apply for probate at this point. A grant of probate letter will be granted which will then give the executor or executors permission to manage the estate of the testator in accordance with the instruction of the will.

A fully completed will should be signed by the testator in the presence of two witnesses. The witnesses must also sign the will in order to confirm the validity of the testator's signature.

The testator and the witnesses should also put their initials on the bottom right-hand corner of each page of the last will and testament.

The will must be kept in a safe place. All executors should be made aware of the existence of the last will and testament.

While it is not mandatory to notarise a will, the testator can choose to do this. This is a further step that can be taken to prove the validity of the document.

It is not mandatory to register a will. However, it is possible to register a will using the National Will Register. It is also possible to store a will via HM Courts and Tribunal Service.

This can help to ensure that the will can be located when the testator dies.

Yes. In order to be valid, a will must be signed by the testator in the presence of two witnesses. Each witness must sign the will to authorise (attest) the signature of the testator.

A witness should:

A will must contain the following:

The following key legal provisions will be relevant to the construction and interpretation of a will:

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Last Will and Testament - Template - Word & PDF

Country: United Kingdom