11/08/2025

11/08/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

11/08/2025

11/08/2025

Word and PDF

Word and PDF

1 page

1 page

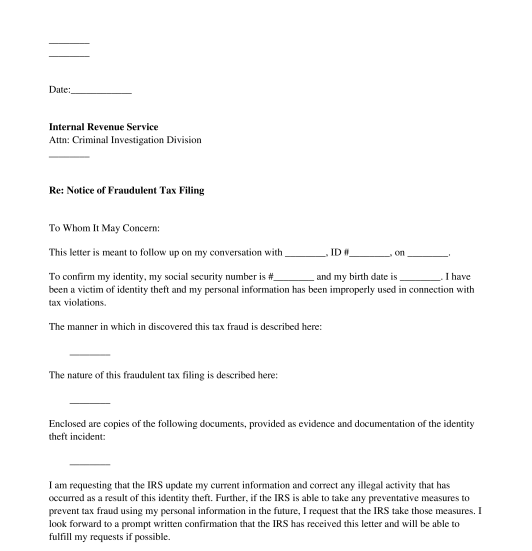

This letter is a document used by a victim of identity theft whose personal information has been used in connection with tax fraud. Sometimes, when a person's social security number and identity has been stolen, the thief is able to file a fraudulent tax filing using the victim's personal information, leaving the victim liable for the resulting tax bill. Once the victim becomes aware that tax fraud has occurred, they generally first notify the Internal Revenue Service (IRS) by phone by calling the IRS Tax Fraud hotline at 1(800) 829-0433 to report that the fraud has occurred. This letter is used to follow up on that initial phone call and provide additional evidence and information about the circumstances surrounding the identity theft and tax fraud. This letter gives the IRS further notice of the issue and provides written documentation and a paper trail of the victim's efforts to rectify the situation.

How to use this document

This letter includes all of the information necessary to follow up on a phone call to the IRS Tax Fraud Hotline reporting an incident of identity theft and tax fraud. The person making this report will be able to include their contact information as well as the name and ID # of the IRS customer service agent to whom they spoke and the date this conversation took place. They can also include their social security number and birth date to help the IRS confirm their identity. Once this basic information has been provided, they can describe in as much detail as possible all of the circumstances surrounding the situation, including the nature of the identity theft, how and when they discovered the fraudulent tax filing, and any other details that would help the IRS investigate this issue and confirm that the tax filing was made fraudulently. The person sending this letter can also specify what additional evidence they will be enclosing with this letter, such as copies of their driver's license, social security card, or other forms of identification; police reports or FTC ID Theft Affidavits they have filed; and any other documentation regarding the tax fraud and how they became aware of it.

Once this letter is completed, the person reporting the tax fraud can send it via certified mail while keeping a copy of the letter for their own records. By using certified mail, they will have written documentation of when the letter was sent and when it was received by the IRS.

Applicable law

Depending on whether federal, state, or city taxes are the subject of this letter, taxes are governed on multiple levels of government, from the federal level down to the local level. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. These taxes are collected by federal, state, and municipal governments. Therefore, a fraudulent tax filing could create a tax burden with any of these entities.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter

Notification of Fraudulent Tax Filing - FREE - Template

Country: United States