11/08/2025

11/08/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

11/08/2025

11/08/2025

Word and PDF

Word and PDF

1 page

1 page

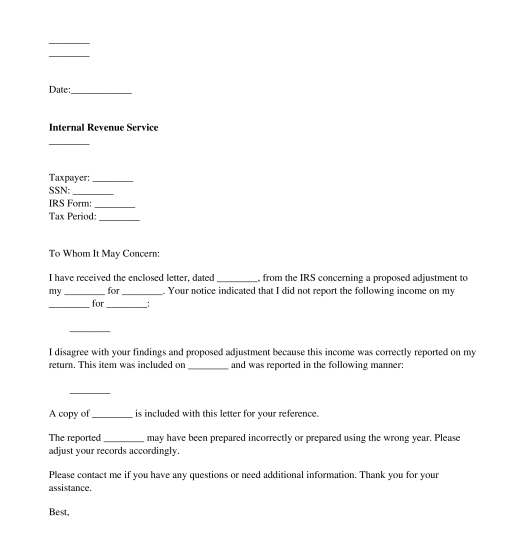

A Response to IRS Notice letter is a document used by a taxpayer, either an individual or a business, to respond to an IRS proposing an adjustment to a tax return, specifically to add items of unreported or incorrectly reported income. This letter is a formal way for the taxpayer to communicate to the IRS that they disagree with its adjustments. The letter gives the taxpayer an opportunity to state why the adjustment is in error and what should be done for the IRS to correct their records.

How to use this document

This letter includes all of the information necessary for a taxpayer to dispute a proposed adjustment by the IRS. The letter includes important identifying information, such as the taxpayer's name, address, and social security number. The letter then outlines the tax form in question and why the taxpayer believes the adjustment is an error.

Common reasons for an IRS error include the income having been reported on a different tax form than the one in question, the income not being reported for a valid reason (e.g. income was already reported on a past return or will be reported on a future return, income was earned by another individual whom the taxpayer is aware of, etc.), or a manual error on the part of the IRS that incorrectly attributes income not associated with the taxpayer to them. Depending on the reason why the taxpayer believes the adjustment was in error, the letter gives them an opportunity to further explain and include any relevant supporting documentation of their claim.

Once this letter is completed, it can be sent via certified mail, along with copies of any supporting documents, to the appropriate IRS office. Using certified mail gives the sender receipt that the letter was sent and received, in case of future dispute.

Applicable law

Depending on whether federal, state, or city taxes are the subject of this letter, taxes are governed by laws on multiple levels of government, from federal to local. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. These taxes collected by federal, state, and municipal governments. Therefore, an adjustment could be the result of taxes filed with any of these entities.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter

Response to IRS Unreported Income Notice - FREE

Country: United States