10/31/2025

10/31/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/31/2025

10/31/2025

Word and PDF

Word and PDF

2 to 4 pages

2 to 4 pages

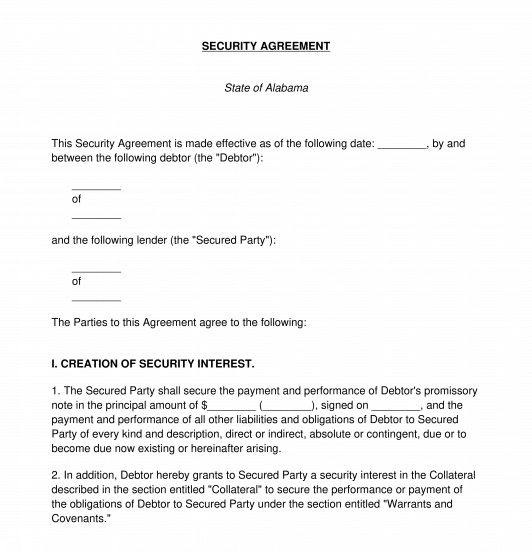

A Security Agreement is a document used by a Borrower and a Lender that gives the Lender the right to take possession of collateral being put up by the Borrower in case the Borrower does not meet their obligations in paying back a loan. The document creates what is known as a security interest. A security interest is an interest in property created by the Security Agreement to guarantee the performance of an obligation, usually the repayment of a debt. It gives the Lender rights over the assets being used as collateral. Typically, a holder of the security interest is entitled to take ownership of, and then sell, the property to pay off the debt owed.

This document is often used in concert with a Secured Promissory Note, or the document where the Borrower agrees to repay a Lender for a loan being made. The Security Agreement guarantees to the Lender an interest in any personal property that is owned by the Borrower free and clear of any other debts so that it may be used as collateral. This personal property could be a vehicle, coins, collectibles, art, or other property of value.

A Security Agreement is not used to transfer or guarantee any interest in real property, like a home or piece of land. To secure a debt using real property as collateral, a Deed of Trust should be used.

How to use this document

This document includes all of the information necessary to create a thorough and well-written Security Agreement. This Agreement includes all of the basic details related to the loan, such as the names and addresses of the Borrower and Lender as well as the amount of the loan and the date the loan was made. Most importantly, the Agreement includes a complete description of the personal property being used as collateral to secure the loan and the location where this property is being kept.

Once the Parties have completed the Agreement, the Borrower and Lender should sign and date it. Both Parties should keep a copy of the Agreement in a safe and secure location for their records and in case of future disputes. If there is an associated Secured Promissory Note, it is a good idea to keep the Agreement in the same location as the Note for future reference.

Applicable Law

Secured Promissory Notes are governed by Article III of the Uniform Commercial Code (the "UCC").

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Security Agreement - FREE - Template - Word & PDF

Country: United States