26/12/2025

26/12/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.6 - 91 votes

Fill out the templateA Commercial Lease Agreement is used when a commercial property is being rented from a landlord (or lessor) to a tenant (or lessee). This lease is used when the purpose of renting out a property is for a commercial activity. For instance, it can be a storage area, a warehouse, a factory etc, related to a business.

This lease will create a legally binding contract between the parties, outlining the rights and responsibilities of both the landlord and the tenant.

A Commercial Lease is different from a Residential Lease or a Retail Lease (explained further below).

There are a variety of different lease agreements used in Australia, including:

A Retail Lease is more tightly regulated than a Commercial Lease. Each state and territory in Australia has specific legislation regarding Retail Leases. Landlords who have property that fits within this retail tenancy legislation must only rent the property out using a Retail Lease. They are likely to face penalties if they fail to do this.

The exact requirements for Retail Leases vary from one state or territory to the other, but it is often a question of the size of the property being leased and/or what it is going to be used for. In general, retail shops and similar businesses are likely to need to use a Retail Lease. Other commercial property such as scrap yards or warehouses may be able to use a general Commercial Lease Agreement.

Each state and territory government has an office or department that deals with fair trading or small business matters, (such as the "Small Business Commissioner" or the office of "Consumer Affairs and Fair Trading"). This is usually a good place to go for information about Retail Leases in the relevant state or territory and to determine whether a Commercial Lease is suitable for the relevant property.

No, but it is highly advisable to have one. Having a written Commercial Lease Agreement helps protect the interests of both the landlord and the tenant. It also helps ensure that both parties understand the terms, and are able to enforce their rights.

First, the parties should check whether the property is suitable for a Commercial Lease, or whether it should be rented through a Retail Lease. If in doubt, seek legal advice.

Before signing a Commercial Lease Agreement the parties should make sure that they understand their rights and obligations. The parties must mutually agree on the terms of the lease. The parties and the relevant property must also be clearly identified. If the property has previously been rented to another tenant, it is also important to make sure that the previous lease has ended.

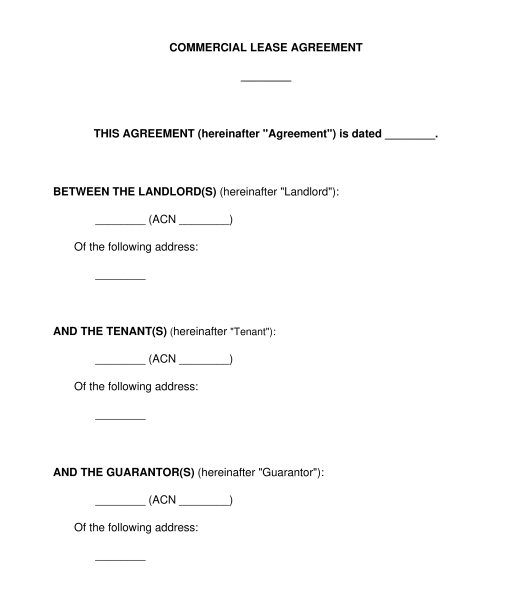

There are a number of parties involved in a Commercial Lease Agreement, including:

Any of these parties can be an individual person or a company. In addition, in the case of the landlord(s), tenant(s) and guarantor(s), there may be just one of them, or there may be two or more of them. For example, if two people own a property together, they would both be the landlords.

Yes. This is usually done through a "permitted use" clause in the lease. The tenant is usually not allowed to use the property for any other purposes, without the landlord's consent. If the tenant does so, then it would be a breach of the lease.

The parties are generally free to negotiate to have whatever duration they like for their Commercial Lease Agreement. However, for long term leases (usually over 5 years, or over 10 years) the parties may need to pay close attention to laws relating to subdivisions in the relevant state or territory. This may be found in conveyancing legislation or in planning legislation. In some cases, leases over a certain length of time are deemed to be subdivisions, according to that legislation.

As a result, the parties may be found to have subdivided land without the appropriate planning approvals. This can lead to prosecution and fines. In addition, a court may refuse to uphold such a lease, meaning that the tenant may be released from the obligation to pay rent.

A guarantor under a Commercial Lease is someone who agrees to be responsible for the tenant's obligations under the lease, if the tenant fails to comply.

For example, a guarantor is often used if the tenant is a company. The landlord may want to make sure that if the company collapses, there is still an actual person (the guarantor) available who can be made responsible for all outstanding rent and other payment obligations. So in these circumstances, the tenant might be a company and the guarantor might be a director of that company.

A security deposit (also known as a bond) is a sum of money often paid by the tenant to the landlord at the start of the lease. If the tenant damages the property in breach of the lease, then the landlord can use the security deposit to pay for repairs. Alternatively, if the tenant stops paying rent (in violation of the lease) then the landlord may be able to use the security deposit to cover the unpaid rent.

A security deposit is not mandatory, but is very common. It is usually equal to 1-3 months rent, although the actual amount can be negotiated between the parties. It is usually paid before the start of the lease, before the tenant gets access to the property. The landlord (or their agent) usually holds the security deposit in a separate account, and if there are no problems, then they return it to the tenant at the end of the lease.

If an option to renew is included in a Commercial Lease, this means that when the initial term of the lease expires, the tenant will have the option to renew the lease for a predefined term.

If the tenant is not in breach of the lease, and follows the necessary steps (which are usually explained in the lease itself - such as providing adequate written notice to the landlord) then the lease will automatically be renewed (the landlord cannot avoid it).

Once the Commercial Lease Agreement is ready, the following things should be done:

There are no documents that must be attached to all Commercial Lease Agreements. However, there are a number of documents that are often attached and are worth considering:

No, witnesses are not mandatory for a Commercial Lease Agreement, but they are useful for evidentiary purposes. If there is ever a dispute over the Commercial Lease Agreement, witnesses can help to prove that each party's signature is valid.

Witnesses should be independent adults (aged over 18), who have the mental capacity to understand what they are doing. They should not be related to one of the parties.

The following details need to be included in a Commercial Lease Agreement:

The various retail tenancy legislation in each state and territory affects some Commercial Leases.

A Commercial Lease is a contract between the landlord and the tenant, and as such, general principles of contract law, as provided by the common law, will apply.

For long term leases, legislation dealing with subdivisions in the applicable state or territory may be relevant. Laws dealing with subdivisions are often contained in conveyancing legislation or planning and land use legislation.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Commercial Lease Agreement (Non-Retail) - template

Country: Australia