13/12/2025

13/12/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

13/12/2025

13/12/2025

Word and PDF

Word and PDF

5 to 7 pages

5 to 7 pages

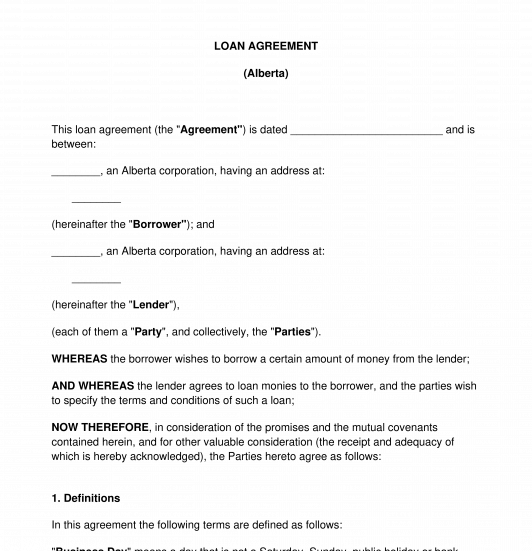

A Loan Agreement is a written contract between a lender (the party providing money) and a borrower (the party receiving money). In exchange for the loan, the borrower pays back the money with the cost of borrowing such money, which is called interest. Its primary function is to serve as written evidence of the amount of debt and the terms under which it will be repaid, including the rate of interest. The contract serves as a legal document that is enforceable in court creating obligations for both, the borrower and the lender.

Though Loan Agreements are often referred to as IOUs or Promissory Notes, Loan Agreements are different than these documents in two key respects: 1. Loan Agreements are binding on both the borrower and the lender; and 2. Loan Agreements are much more detailed and include extensive provisions about when and how the borrower will repay the loan and what sorts of penalties will be incurred if the borrower does not follow through with repayment. Loan Agreements are usually used when large sums of money are involved, such as student loans, mortgages, car loans, and business loans. For smaller and/or more informal loans, such as those between family and friends, a Promissory Note should be used.

How to use this document ?

This Agreement sets out all of the terms and details of the loan, including the names and addresses of the Borrower and Lender, the amount of money being borrowed, how often payments will be made, the amount of the payments, and the signatures of the parties.

Several types of loans are accessible within this form:

It is also possible to specify whether or not interest will accrue on the loan and, if so, the interest rate that will be used. There is the option of including provisions to govern early payments as well as an acceleration clause that would cause the entirety of the loan to come due in the event of late payments or non-payment according to the agreed upon payment plan schedule.

This document should be read carefully by the parties and the guarantors (where applicable). Every party should then sign and keep a physical copy of the Loan Agreement.

Where a company is a party to this agreement, they should ensure that the Loan Agreement is signed by an authorized signatory. Where the lender has requested that the borrower provide guarantors, those guarantors should also carefully read the entire Loan Agreement and their guarantee obligations, and sign where indicated.

Applicable law

This agreement is subject to the broad principles of contract law.

Where the borrower has provided security, lenders may wish to 'perfect' that security in accordance with the provisions of the provincial or territorial law in effect.

If a lender is a company, and the Loan is being provided to a shareholder of that company, parties should be aware of sections 15(1.2), s. 15(2), s. 80.4(2), s. 110(1)(j) of the Income Tax Act, which stipulates that such a loan may be deemed a benefit and be taxable as income for shareholders.

In the case of payday loans, the parties may wish to refer to the provincial or territorial act on consumer protection as payday loans are often the subject to specific rules.

How to modify the template?

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Loan Agreement - Template, online sample - Word and PDF

Country: Canada (English)