11/01/2025

11/01/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.8 - 236 votes

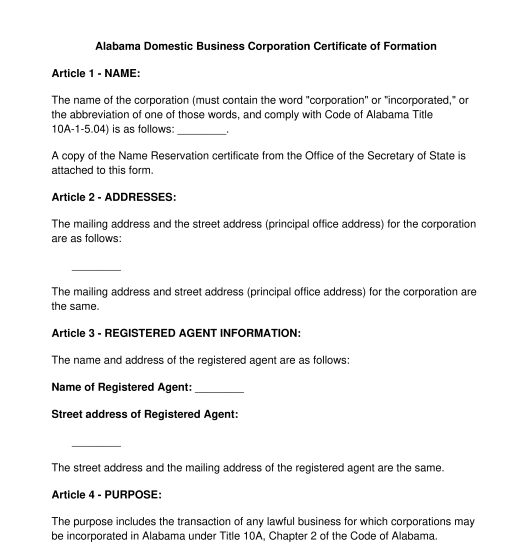

Download a basic template (FREE) Create a customized documentArticles of Incorporation (sometimes called Certificates of Incorporation or Certificates of Formation) are the document by which corporations - those businesses with a specific tax structure that are designated by "Inc." or "Corp." - are established, state by state. In order to begin any official corporation in any state, the incorporators must let the local government of that state know that they plan to do business there and that they would like to apply as a corporation there.

Articles of Incorporation are the document created by a the new business to let the state know that the business has been created and they are applying to be a corporation operating in that state.

The Articles of Incorporation are usually very straightforward and there does not need to be much information already established about how the corporation plans to do business.This document acts a first step and compiles all of the basic information about the new corporation needed in the specific state where the corporation will be operating. Be aware that some states have extra requirements for their Articles of Incorporation filings, such as the accompaniment of a cover letter or an extra consent form. While this document will be what is needed for the actual Articles of Incorporation, additional documents may be required to complete the formation of the new corporation.

Articles of Incorporation are used only for businesses that are being established as corporations. With a corporation, the business structure (e.g. the company itself) and the people who own the corporation are taxed separately. By contrast, Articles of Organization are used for businesses being established as limited liability companies (LLCs). LLCs are taxed just once at the individual level, known as pass through taxation, instead of being taxed at both the company level and individual level.

This document can be used for incorporators (or just one incorporator) that have decided to form a Corporation. In this document, the user will enter the identifying details of the corporation such as name and address. The user will also be able to customize the following details:

Once this document is done, it should be signed and dated by the incorporators. In several states, these signatures should be witnessed and notarized by a notary public. In states where notarization is necessary, the relevant notary page will automatically be included with this document.

The signed and, if applicable, notarized document should be filed with the secretary of state's office in the state where the corporation plans to incorporate. Many states allow online filing. There is generally a filing fee associated with the filing and costs between $100 and $300 depending on the state. If the newly formed corporation has shareholders, or individuals who own shares in the corporation, it may be prudent to create a Shareholders Agreement. The Shareholder Agreement outlines the basic responsibilities of the corporation towards the shareholders and the responsibilities of the shareholders towards the corporation.

Articles of Incorporation are subject to the laws of individual states. There is no one federal law covering the requirements for Articles of Incorporation. This is because each individual state governs the businesses formed within that state.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Choose the Best Legal Structure for your Business

Articles Of Incorporation - FREE - Sample, template

Country: United States