11/14/2025

11/14/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.8 - 966 votes

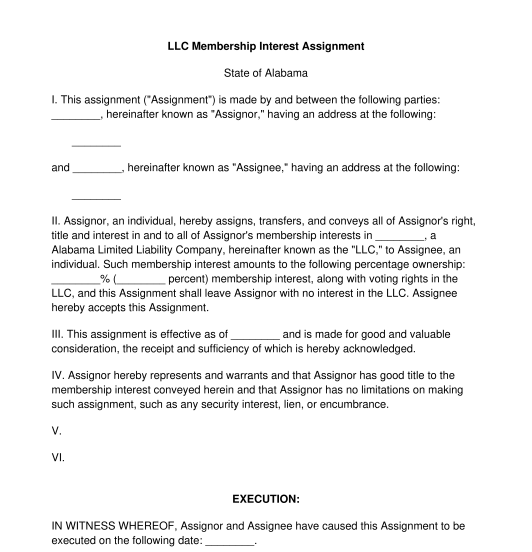

Download a basic template (FREE) Create a customized documentAn LLC membership interest assignment is a document used when one member of a limited liability company ("LLC") wishes to transfer the entirety of their interest in an LLC to another party. This document is often used when a member of an LLC is leaving or otherwise wants to give up the entirety of their interest in the company. Using this document, the current owner of shares in the LLC transfers all of them over to another person or entity.

A limited liability company, also known as an LLC, is a corporate structure that protects its owners from being personally liable for debts and liabilities of the company. LLCs do not pay taxes on their profits directly. Instead, profits and losses are passed through to the individual members, who report them on their personal tax returns.

Though both documents involve the transfer of interest in an LLC from one party to another, these two documents serve different purposes. The LLC membership interest assignment transfers the entirety of one person's interest in the LLC to another person. It is also not a sale document.

An LLC membership purchase agreement is the sale of some portion of a party's interest in an LLC to another party.For example, if someone owned 50% interest in an LLC, they could sell 25% of their interest in the LLC to another party and keep the remaining 25% interest for themselves.

Yes, using an LLC membership interest assignment is mandatory in most states. In the few states where it is not mandatory, it is still highly advisable to use this document to be sure to protect the interests of the parties involved and to make sure all the members of the LLC are informed about the ownership transfer.

Membership interest is a party's ownership stake in an LLC. It represents the parties' right to share in the profits and losses of the LLC and to receive distributions from it.

Prior to creating an LLC membership interest assignment, several things should happen. Firstly, the parties should review the LLC's operating agreement. This document may contain restrictions or requirements for the transfer of interest in the LLC. For example, the operating agreement may require that existing members of the LLC have the right to buy the interest in the LLC before it is sold to any outside third party.

The parties to the agreement should also get consent to the sale from the current members of the LLC. This is not always necessary, but it is common and usually considered good practice.

Before agreeing to the terms of the LLC membership interest assignment, the new owner should also do research into the LLC to be sure that it is in good standing and not involved in ongoing litigation or bankruptcy proceedings.

The LLC membership interest assignment includes the party giving up their interest in an LLC and the party receiving the interest in the LLC. Both of these parties can either be individual people or entities, like a business or charitable organization.

Once the LLC membership interest assignment is done, it should be signed and dated both the assigning party and the receiving party. All members of the LLC should be notified of the transfer. This notification usually happens by providing a copy of the Assignment and any related documents to the LLC's registered agent or manager. Information about the process is typically specified in the LLC Operating Agreement. In some states, transfer of interest in an LLC requires that formation documents be updated and refiled with the appropriate state office to reflect changes in membership. This may also involve filing an amendment to the Articles of Organization. The LLC should be sure to update its bank accounts, contracts, licenses, and permits as necessary to reflect the membership change. Finally, the LLC should maintain accurate records of the transfer of interest, saving for future reference copies of the Assignment Agreement, amended Operating Agreement, consent of members, and any other relevant documents.

In some states, transfer of interest in an LLC requires that formation documents be updated and refiled with the appropriate state office to reflect changes in membership. This may also involve filing an amendment to the Articles of Organization.

A valid LLC membership interest assignment must contain at least the following mandatory clauses:

In addition to the above mandatory clauses, the LLC membership interest assignment may also include the following optional clause:

LLC Membership Interest Assignments are subject to the laws of individual states. There is no one federal law covering these documents because each individual state governs the businesses formed within that state.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

LLC Membership Interest Assignment - FREE - Template

Country: United States