11/23/2025

11/23/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

11/23/2025

11/23/2025

Word and PDF

Word and PDF

3 to 4 pages

3 to 4 pages

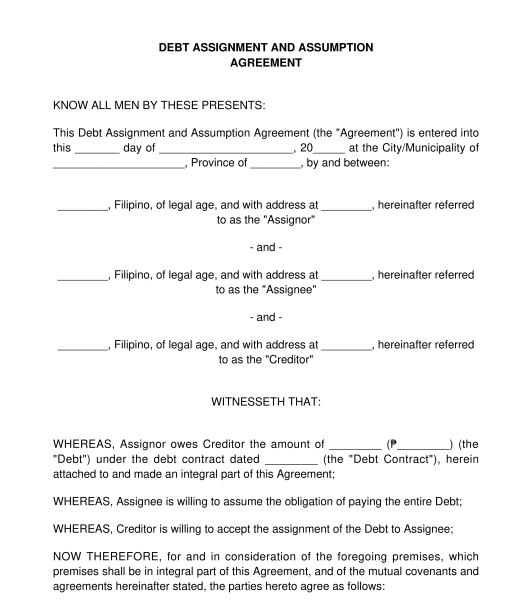

A Debt Assignment and Assumption Agreement is a document whereby one party (the "assignor") assigns their debt to another party (the "assignee"), and the assignee agrees to pay the debt to the assignor's creditor.

A Debt Assignment and Assumption Agreement presumes that there is a debt that the assignor needs to pay to the creditor. This debt could arise from any circumstance, including a loan or maybe an unpaid contract of sale or services. In any case, this debt is then assigned (or transferred) to the assignee who will now have the obligation to pay the creditor. The parties may also choose whether the entire debt will be assigned or only a portion of it.

This document offers the option of having the debt transferred to the assignee completely or that the assignor and the assignee will be liable for the debt together. In the first option, the creditor will no longer have the right to ask for payment from the assignor even if the assignee fails to pay. In the second option, the creditor should first ask for payment from the assignee and, if the assignee fails to pay, they can ask for payment from the assignor. Either way, the creditor should sign and agree to the terms of the Debt Assignment and Assumption Agreement.

The user should enter all the information necessary to complete the document. This includes the names and addresses of the assignor, the assignee, and the creditor, the total amount of the debt, and, if only a portion of the debt will be transferred, the amount that will be transferred. Once the document is completed, it should be carefully reviewed by all the parties and, if the document is correct, it should be signed by all the parties.

Each party should keep a copy of the document for their records.

Notarizing the document

If the parties would want to notarize the Debt Assignment and Assumption Agreement, the document also includes an Acknowledgment portion. Notarization of the document converts the document from a private document to a public document so that it becomes admissible in court without need of further proof of its authenticity.

To notarize the document, the parties must print and sign an extra copy (for the notary public) of the document and bring all the copies to a notary public to acknowledge that they have signed the Debt Assignment and Assumption Agreement freely and voluntarily. They should also present a valid I.D. issued by an official agency bearing their photograph and signature such as a driver's license or a passport, among others.

Notarizing this document is optional.

Once notarized, the parties should each keep at least one (1) copy of the notarized document and the notary public will also keep one (1) copy for their notarial book.

The laws on contracts and obligations under the Civil Code of the Philippines apply.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Debt Assignment and Assumption Agreement - template

Country: Philippines