12/06/2025

12/06/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

12/06/2025

12/06/2025

Word and PDF

Word and PDF

3 to 5 pages

3 to 5 pages

In a Loan Agreement, one person or entity (the creditor) lends money to another person or entity (the debtor) who promises to pay back the money at a certain moment. The loan can be paid back with or without interest. The Loan Agreement contains the amount of the debt and the terms and conditions of the loan.

Note that the loan agreement can include something of value called security that will be used to ensure the payment of the loan, it can be personal property (e.g. car, jewelry, and other expensive personal items) or real property (e.g. lands and buildings) owned by the debtor.

In a Loan Agreement without interest, the debtor is only obliged to pay the amount of money lent to him by the creditor. On the other hand, in a Loan Agreement with interest, the debtor must pay not only the amount of money borrowed but also a certain percentage of the said amount called interest which is usually at 6% per year.

For example, in a Loan Agreement without interest where the amount borrowed is PHP 1000.00, the debtor would only have to pay PHP 1000.00. In a Loan Agreement with interest where the amount borrowed is PHP 1000.00 on January 1, 2024, and the interest rate is 5% per year, then at the end of the year i.e December 31, 2024, the borrower would have to pay PHP 1050.00

Note that the current legal interest rate is 6% per year. There are many cases where high interest rates are struck down and declared illegal by the Supreme Court.

If there will be a requirement by the creditor for the debtor to pay interest or penalty rate (if the debtor has to pay a fixed amount if he fails to pay back the loan on time), then there must be a written Loan Agreement for the creditor to be able to ask for the payment of the same. Otherwise, the creditor cannot ask for the payment of interest or penalty from the debtor.

If the creditor does not want to impose the payment of interest or penalty, it is not mandatory to have a written Loan Agreement, but it can still be recommended in case a large sum of money is lent to the debtor to have more security, and for it to be paid back as agreed.

Security can be personal property (e.g. car, jewelry, and other expensive personal items) or real property (e.g. lands and buildings) of the debtor, which will be used to ensure the payment of the loan. This arrangement is more commonly called a secured loan. In case the debtor does not pay back the loan, the security can be sold, and the price by which it is sold is used to pay back the loan.

In order for other persons who are not a party to the Loan Agreement to respect the security given for the payment of the loan, the condition of placing a security must be in writing or stated in the Loan Agreement, and it must follow certain conditions.

To use a property as security, the debtor must be the actual owner of the property or if the debtor is an agent of another person, he must be legally authorized to use the property as security i.e. through a Special Power of Attorney. If the debtor is married and the property given as security is part of the conjugal property or property acquired during the marriage of the debtor and his spouse, then the debtor's spouse must also give their consent to use the property as security.

Take note of the following conditions:

If there is a security for the payment of the loan, the creditor cannot automatically obtain ownership over the thing used as security. The security should be sold first in a public auction and the proceeds will be used to pay back the loan.

Further, the creditor is not permitted by law to hide certain fees and expenses for the loan, the law requires transparency. The principal amount as well as the interests, penalties, and other costs must be clearly stated.

Lastly, the creditor should avoid setting very high interest rates, e.g. more than 6% per annum.

If there will be payment of installments (continuous recurring payments), the Loan Agreement exists so long as installment payments are still due.

If there will be no payment of installments and interest (lump-sum payment or payment made at once), the loan amount should be fully paid before the due date (the date on which the loan should be paid) provided under the Loan Agreement, if the lump-sum payment is not yet made, then the Loan Agreement still exists.

Note that so long as the loan is not fully paid, the terms and conditions under the Loan Agreement still apply.

Once completed, at least two original copies of the Loan Agreement should be printed for each party or in such number of original copies as there are creditors and debtors. The parties must review the Loan Agreement carefully before signing and/or notarizing the same.

The Loan Agreement has different contents in the Acknowledgment portion depending on whether there is a security given to ensure the payment of the loan:

If the Loan Agreement will be notarized, at least three original copies of the Loan Agreement should be printed for each party or in such number of original copies as there are creditors and debtors, then the parties must personally go before a notary public with competent proof of identification and sign the Loan Agreement. If the acknowledgment portion includes an Affidavit of Good Faith, the parties must also sign the same in front of the notary public.

The creditor and debtor should keep one original copy for each (or in such number of original copies as there are creditors and debtors). The third or last original copy should be given to the notary public. Note that an original copy should be signed by the debtor and creditor and not merely photocopies.

The schedule of payment for loan payments which corresponds to those stated in the Loan Agreement may be attached to the Loan Agreement if desired. This is also for the reference of the debtor.

If a representative will sign for any of the parties the following should be attached:

Notarization of the Loan Agreement is necessary if the loan is secured either with personal or real property.

In case there is no security, notarization is optional. Notarization will make the existence of the Loan Agreement easier to prove in case a dispute concerning the same is brought to court. Further, notarization makes the Loan Agreement a public document, which forces other persons who are not parties to the Loan Agreement to respect the terms and conditions in the Loan Agreement including the security placed to ensure the payment of the loan.

Notarization fees for a Loan Agreement are typically PHP100 to PHP500. However, some notaries public may charge based on the percentage of the amount of loan involved, which is usually ay 1% e.g. if the amount of the loan is PHP 100,000.00, then the notary public may charge PHP1000.00.

Further, if the Loan Agreement is secured with personal or real property, the Philippine Personal Property Security Registry (PPSR) or Register of Deeds will ask for registration fees. For this purpose, the schedule of fees by the said government agencies should be checked using the link provided.

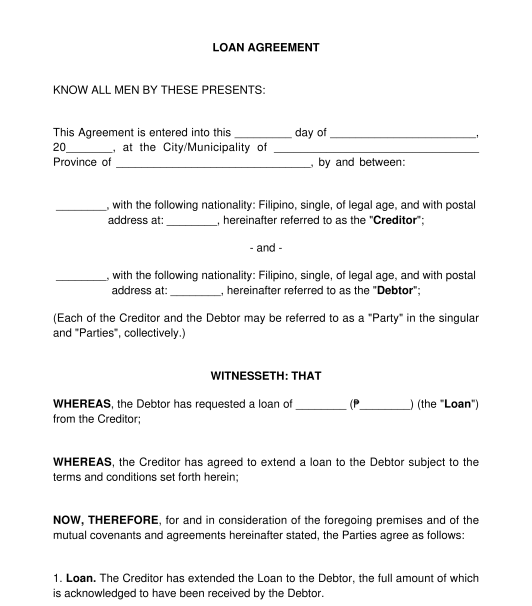

A Loan Agreement contains the following information:

There are a number of special laws that affect Loan Agreements, however, general law for Loan Agreements can be found in the Civil Code of the Philippines. Additionally, to properly secure a Loan Agreement by Personal Property, the provision of the R.A. 11057 or the Personal Property Security Act should be complied with.

The Truth in Lending Act is also applicable to Loan Agreements.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Loan Agreement - sample template online - Word and PDF

Country: Philippines