02/11/2025

02/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

02/11/2025

02/11/2025

Word and PDF

Word and PDF

13 to 19 pages

13 to 19 pages

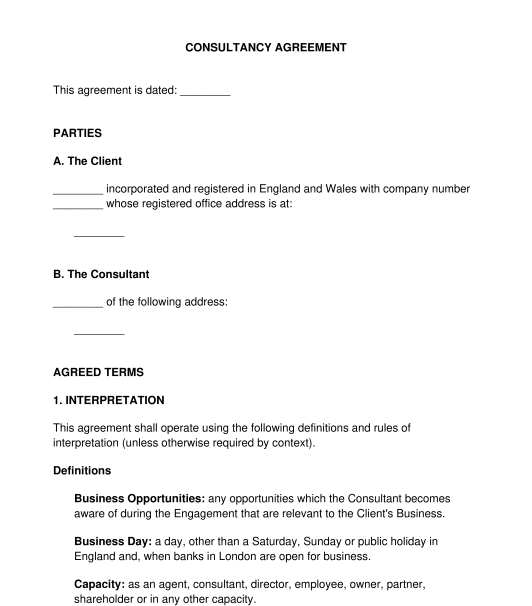

A consultancy agreement is a contract between an independent contractor and an entity for the provision of consultancy services. Under this agreement, the independent contractor is referred to as the Consultant and generally to carry out advisory services (e.g. business consulting) for the Client.

The main difference between a consultancy agreement and a service contract is the nature of the engagement.

Under a consultancy agreement, the independent contractor will be providing expert advice, often targeted towards completing a specific project. The consultant will assist the client in accomplishing the task.

Under a service contract, the contractor is not limited to providing advisory services to the client, but can also handle a broader range of services on an ongoing basis (e.g. An Engineer, A Mechanic etc).

An employment agreement is a contract between an employer and an individual who will be hired as an employee. The employer will have direct control over the way the employee carries out their duties, for which they will be paid a salary. The employee will also be entitled to certain rights, such as the right to holiday and holiday pay, the right to sick leave and sick pay, and so on.

Under a consultancy agreement, the consultant will be an independent contractor who is not directly controlled by the client. The consultant can choose how they wish to carry out the services, they will not be entitled to the same rights that an employee would. The consultant will also have the option to carry out the service through an intermediary (usually a company).

The effect of using an intermediary is that the Consultant's income tax and NI (national insurance) contributions will not apply. Because this arrangement may be beneficial to both the Client and the Contractor, the UK has implemented the IR35 rules that aim to stop people from abusing the benefits of using an intermediary.

If the parties do not want to be affected by the IR35 rules, the consultancy agreement will need to be drafted in a way that makes it clear that there is no employer-employee relationship between the Consultant and Client.

No, it is not mandatory to have a consultancy agreement as it is possible to have a valid oral contract. However, it is highly recommended to have a written consultancy agreement with clearly stated terms and conditions, as well as the rights and obligations of the parties.

Under the consultancy agreement, the Consultant can either provide the consulting services themselves as an individual, or they can use an intermediary (usually referred to as a personal service company). A Personal Service Company refers to a limited company whose main shareholder is also a director and that person uses the limited company to take up businesses and provide services to clients, instead of working directly with clients in a personal capacity or taking up employment. In other words, the Personal Service Company is used as a means through which the main shareholder transacts with clients. Under either option, the Consultant will not be deemed to be employed by the Client.

The duration of a consultancy agreement is dependent on the particular project that the consultant is being hired to undertake. The scope of the project, as well as the expected completion date will be the major considerations for the parties when choosing a duration for the consultancy agreement. The duration of the consultancy agreement can either be for a fixed length of time or for an indefinite length of time, as the parties see fit.

When the consultancy agreement is filled out, it should be printed, signed by both parties, and a copy should be kept with each party.

The following documents can be attached to a consulancy agreement:

No, it is not necessary to have witnesses for a consultancy agreement. Once it has been signed by both parties, it has been properly executed.

The consultancy agreement can be terminated based on the terms and duration of the agreement. If the consultancy agreement is for a fixed period of time, then the agreement will come to an end when that time expires, except the parties agree to extend it. If the consultancy agreement is for an indefinite period of time, then the agreement will have to be terminated in the way required in the agreement. This may be by either party informing the other of the intention to end the agreement.

The most important details under such a Consultancy Agreement which must be entered are as follows:

Contracts (Rights of Third Parties) Act 1999

Contracts (Rights of Third Parties) (Scotland) Act 2017

Income Tax (Earnings and Pensions) Act 2003

Supply of Goods and Services Act 1982

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Consultancy Agreement - Sample, template - Word and PDF

Country: United Kingdom