12/12/2025

12/12/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

12/12/2025

12/12/2025

Word and PDF

Word and PDF

7 pages

7 pages

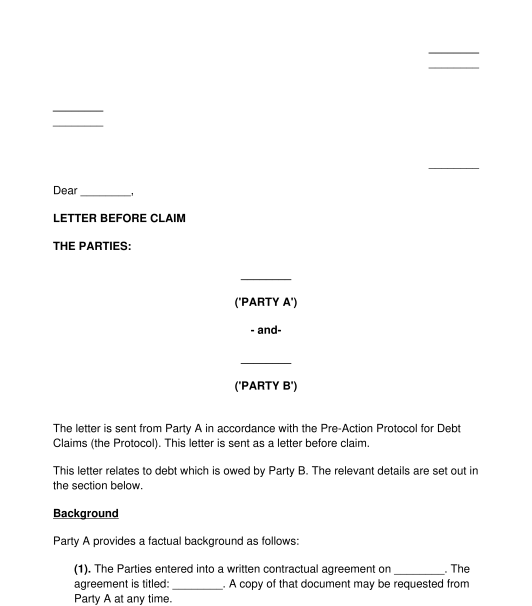

A letter before claim for unpaid debt will be used by a business where an individual owes them money in England and Wales. The purpose of the letter is to warn the individual that the business intends to make a court claim in the Civil Court in relation to the debt. The letter provides a final opportunity for payment to be made.

A letter before claim for debt is designed for use where the Debt Protocol applies. This is a specific procedure applicable to debt claims in the Civil Court. The Debt Protocol applies where a business (including a sole trader) is claiming debt from an individual person.

For other types of civil claims, including commercial debts (where both the creditor and debtor are businesses), different letter before claim can be used. This is because there are different rates of interest and implied terms of payment for commercial debts.

If the future claim will be made in Scotland, a letter before claim should be sent in accordance with the Simple Procedure.

Yes, if a business intends to issue a court claim in relation to the debt owed by an individual, it is important to follow the principles set out within the Debt Protocol. A letter before claim should be sent in compliance with the Debt Protocol. The Court could impose sanctions where a party fails to comply with the Debt Protocol.

The person who owes the debt is a debtor.

The creditor is the party that is demanding and claiming the debt (the party sending the letter).

An assignment of debt involves the situation where the original creditor transfers the debt to another third party (the assignee) and the assignee then holds the right to receive the repayment of the debt. If the debt is assigned, the assignee can generally bring a claim in relation to the debt. This is done via a contractual agreement.

This letter before claim should be used by a business that is claiming debt from an individual. A letter before claim for unpaid debt can also be sent from an assignee (a party that has had the debt assigned to them by a business).

Once the letter has been signed and the documents have been attached, it can be sent by post. The letter should be sent on the day is signed and dated, or if that is not reasonably possible the next day after signing. The creditor may wish to send the letter in a tracked format so that it can prove the date of sending and the date of receipt.

The letter should only be sent via email if the debtor has made an express request that correspondence should not be sent via post and should be sent in this manner instead.

Once the letter has been signed, a copy of the following documents from the Debt Protocol rules must be enclosed with the letter:

A sender may also choose to enclose:

If the debtor does not respond or make a payment within 30 days of the date of the letter, the creditor may then take steps to issue court proceedings.

The letter should:

Debts owed by an individual to a business are generally governed by a contractual agreement.

The Civil Procedure Rules - the Pre-action Protocol for Debt Claims (Debt Protocol) apply to debts of this nature.

The Law of Property Act 1925 governs the assignment of debts.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Country: United Kingdom