18/11/2025

18/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

18/11/2025

18/11/2025

Word and PDF

Word and PDF

1 page

1 page

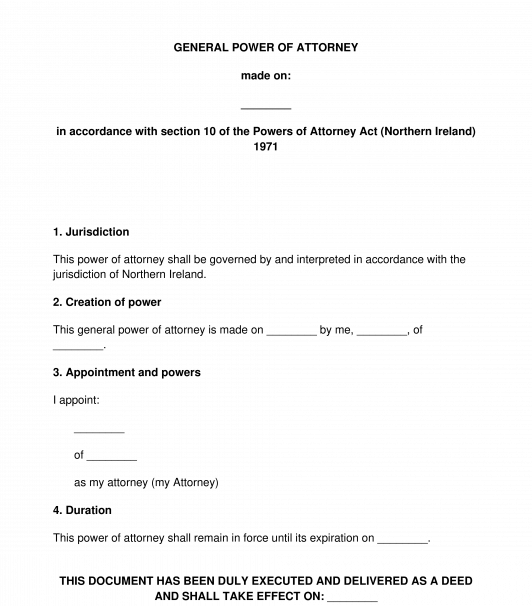

This document can to be used to create an Ordinary Power of Attorney (also known as an General Power of Attorney) for use in Northern Ireland. It is also possible to create a Power of Attorney for use in Scotland, through a different process. It is also possible to create an Ordinary Power of Attorney for use in England and Wales using a different process.

An Ordinary Power of Attorney is a formal document which can be used by one person or a company (a donor) to give power to another person or company (the attorney) or, sometimes, to multiple people/companies (the attorneys) to deal with affairs on their behalf. For example, a donor could use an Ordinary Power of Attorney to give power to an attorney for the purposes of:-

Common situations where an Ordinary Power of Attorney might be used are:-

An Ordinary Power of Attorney can be created to confer a broad (general) power from a donor to an attorney to manage their affairs generally. Alternatively, an Ordinary Power of Attorney can be created to give very specific powers to the Attorney (a Limited Power of Attorney). A Limited Power of Attorney might be used, for example, to give an attorney power to conduct a specific property transaction.

There are limits on the sorts of powers which can be given to an attorney via an Ordinary Power of Attorney. For example, an Ordinary Power of Attorney cannot be used to give an attorney the power to carry out acts that relate solely to the donor's status (for example to carry out acts which are specific to a husband, wife, lawyer, doctor etc.) or to authorise acts which are unlawful/criminal

In addition, there are different rules for trustees (those who have been already given powers via a trust). Trustees, in general, can create an Ordinary Power of Attorney in order to delegate their trustee powers provided that:-

It is especially important to note that an Ordinary Power of Attorney SHOULD NOT be used:-

Instead, if a person wants to make arrangements for somebody to make decisions on their behalf or to manage their finances in the event that they become incapacitated, then an Enduring Power of Attorney should be used

An Ordinary Power of Attorney does not need to be registered, and the power is created through the execution of the document as a valid deed.

It is useful to note that an Ordinary Power of Attorney can often be incorporated into other agreements (for example, as part of a transactional contract). In those circumstances, this document for a stand alone Ordinary Power of Attorney is not suitable.

How to Use This Document

This document can be used to create stand alone Ordinary Power of Attorney or a Trustee Power of Attorney. It should be completed with the full details, providing the accurate details for both the donor and the attorney.

The donor can be either:-

The attorney can be:-

An Ordinary Power of Attorney takes the form of a deed and in order to take effect it must be executed properly as a deed. A Trustee Power of Attorney must be attested by at least one witness.

For a donor who is an individual, a deed must be executed by either:-

For a corporate donor that is a UK company, the document must be executed by either:-

For a corporate donor that is a Limited Liability Partnership, the document must be executed by either:-

Care should be taken to ensure that the document is correctly witnessed, and that the witness is suitable and is legally able to witness the document.

It is important to note that an Ordinary Power of Attorney will generally, save for in the cases of irrevocable powers of attorney and trustee powers of attorney, be terminated in any of the following circumstances:-

It is possible to create an irrevocable Ordinary Power of Attorney (which cannot be revoked without the attorney's consent and is not subject to the usual termination rules as described above) if:

Relevant Law

The main statute governing Ordinary Powers of Attorney in Northern Ireland is the Powers of Attorney Act (Northern Ireland) 1971

The main statute governing Trustee Powers of Attorney in Northern Ireland is the Trustee Act (Northern Ireland) 1958

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: Signing Documents in England and Wales

Country: United Kingdom