11/03/2025

11/03/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.8 - 142 votes

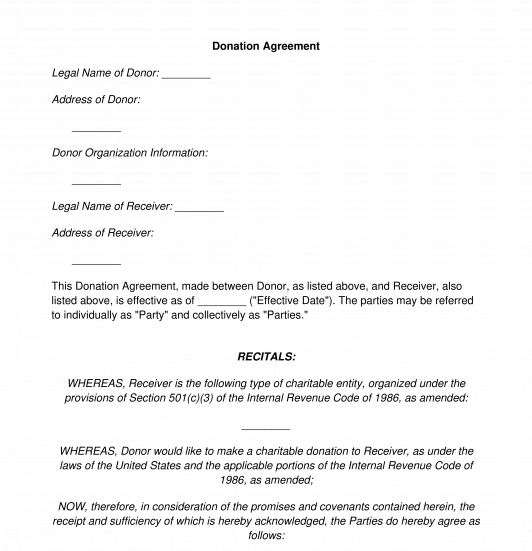

Download a basic template (FREE) Create a customized documentA Donation Agreement, also sometimes called a Charitable Gift Agreement, provides written proof for a donation, or gift, that has been given to a charitable organization in the United States. A Donation Agreement is important for both parties to the contract: the charitable organization (often called the receiver) and the person or entity donating (often call the donor). The charitable organization must keep accurate records of donations received, but so must the donor keep records of the donations they have given. Having accurate financial records on file will help both parties in their internal record-keeping and also when it comes to tax time.

In a Donation Agreement, the most important details of the parties' relationship will be entered: things such as the parties' identities, a description of the donation, and, if desired, things like the form of the receipt that was given and the intended use for the donation. A good Donation Agreement will also discuss revocability (whether the donation can be taken back) and expense responsibility.

How to use this document

This document can be used for a company or person who is getting ready to donate to a charitable organization, organized under Section 501(c)(3) of the Internal Revenue Code. In this document, the form-filler will be able to enter pertinent identifying details, such as whether the parties are individuals or businesses, their contact information, and, of course, all of the details of the donation, including its monetary value.

After this document is filled out, it should be printed so that both parties can sign it. Then, a best practice is for both parties to keep a copy.

Applicable law

Donation agreements in the United States are subject to the Internal Revenue Code, overseen by the Internal Revenue Service, or IRS. Specifically, Section 501(c)(3) of the Internal Revenue Code covers charitable organizations.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Donation Agreement - FREE - Template - Word & PDF

Country: United States