10/31/2025

10/31/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/31/2025

10/31/2025

Word and PDF

Word and PDF

3 to 4 pages

3 to 4 pages

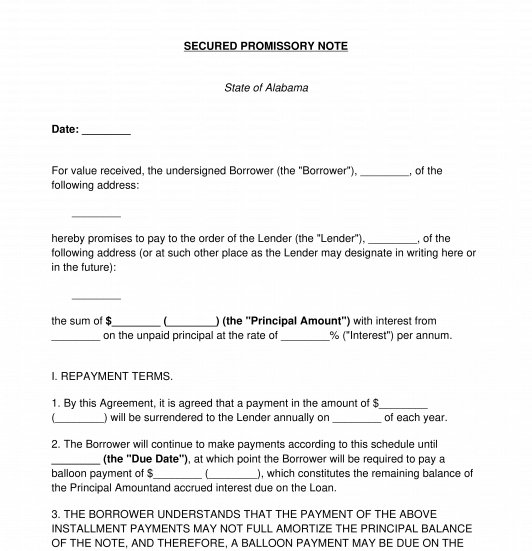

A Secured Promissory Note is a document used so that a party borrowing money, known as the Borrower, agrees to repay a party lending money, known as the Lender. The word "secured" means that the loan is backed by an asset put up as collateral. If the loan cannot be repaid the collateral is forfeited to the lender.

Some parties choose to use a regular Promissory Note to memorialize a loan. However, this document provides extra security by including collateral that the Borrower promises to relinquish to the Lender if they do not repay the loan as described in the Note. This collateral can be either personal property, such as a car or jewelry, or real estate, such as a piece of land. By using a Secured Promissory Note, the Borrower will be able to offer an additional incentive that can convince the Lender to make the loan and the Lender will have additional assurance that the Borrower will pay the loan back by its due date.

Generally, a Secured Promissory Note will be secured using an additional document. If the property being used as collateral is personal property, the Note will be secured using a Security Agreement. If the property being used as collateral is real property, the Note will be secured using a Deed of Trust. In the event of default, or the Borrower failing to pay back the loan as agreed upon in the Note, the Security Agreement or Deed of Trust allows the Lender to use or sell the collateral to recover the money loaned to the Borrower. The Secured Promissory Note is binding on the Borrower and obliges them to repay the loan to the Lender. A Security Agreement or Deed of Trust is the document that allows the Lender to then take possession of the property that the Borrower is using as collateral in the Secured Promissory Note. Having a Security Agreement or Deed of Trust is not mandatory to create a binding Secured Promissory Note, but having one of those companion documents does make things much easier for the Lender to take remedial action if things go wrong.

Though a Secured Promissory Note is similar to a Loan Agreement, this document is only binding on the Borrower. This means that only the Borrower is bound to actions (i.e. repaying the loan) and consequences (i.e. late fees and forfeiture of the collateral). In fact, Lenders don't even sign Promissory Notes - only Borrowers do.

Often, Secured Promissory Notes are used in place of more formal loan agreements when the loan is being made informally between friends or family members. Secured Promissory Notes can even sometimes be used between very small businesses. When more formal loans are made between bigger businesses or banks, for example, that is when loan agreements are used.

How to use this document

This document includes all of the information necessary to create a thorough and well-written Secured Promissory Note. This Note sets out all of the basic terms and details of the loan, including the names and addresses of the Borrower and Lender, the amount of money being borrowed, how often payments will be made, the amount of the payments, and any applicable interest rates or late fees. The Note specifies how the money will be repaid and includes several common repayment options:

Finally, the Note includes a description of the property that is being used as collateral and under what circumstances its ownership will transfer to the Lender.

Once the Parties have completed the Note, the Borrower should sign and date it. Both Parties should keep a copy of the note in a safe and secure location for their records and in case of future dispute.

Applicable Law

Secured Promissory Notes are governed by Article III of the Uniform Commercial Code (the "UCC").

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: Mortgage Deed vs. Deed of Trust

Secured Promissory Note - FREE - Sample, template

Country: United States