27-09-2025

27-09-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

27-09-2025

27-09-2025

Word and PDF

Word and PDF

1 page

1 page

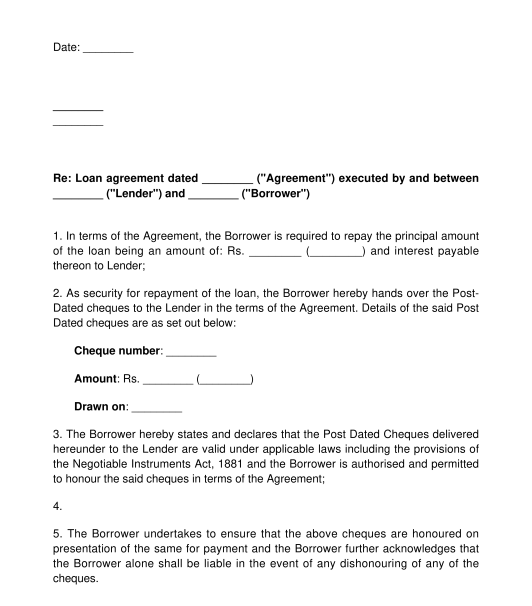

The Cheque Deposit Letter Pursuant to a Loan Agreement is a document that is used to hand over post-dated cheques or undated cheques as security for repayment of the loan by a borrower. Often, lenders require borrowers to hand over cheques as security since a default in repayment of the loan gives the lender a right to deposit the cheques and claim its money back. It is a quicker way to recover the amounts loaned and therefore is preferred by some lenders including banks.

This letter is regarding the cheque deposit after entering into a loan agreement. A separate loan agreement is available on this website.

This document can be used by a borrower who is required to hand over post-dated cheques or undated cheques as security for repayment of a loan to the lender. In this letter for the deposit of cheques, all pertinent details can be filled out, such as the name of the borrower and lender, loan amount and cheque numbers and amounts for which the cheques are being submitted.

Two copies of the letter can be printed and signed by the borrower, and one copy can be retained for the record while the other handed over to the lender. The lender's signature can be obtained on the letter as an acknowledgement of receipt of the letter and cheques. The letter can be delivered personally if handing over the cheques in person or by post/courier.

In case the borrower deposits these cheques with the lender then, subject to the terms of the loan, a default in repayment of the loan amount would give a right to the lender to deposit the cheques for the unpaid amounts and recover the same. In case of insufficient balance in the account of the borrower, the cheque 'bounces' i.e. is dishonoured and gives a right to the lender to take action under Section 138 of the Negotiable Instruments Act, 1881 under which dishonour of a cheque is a criminal offence. While there have been varying views of courts regarding the above and whether an action can be taken under Section 138 of the Negotiable Instruments Act 1881, recent judgments of the Supreme Court appear to confirm the same.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Lend Money and do not Lose them Forever?

Country: India