06-11-2025

06-11-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

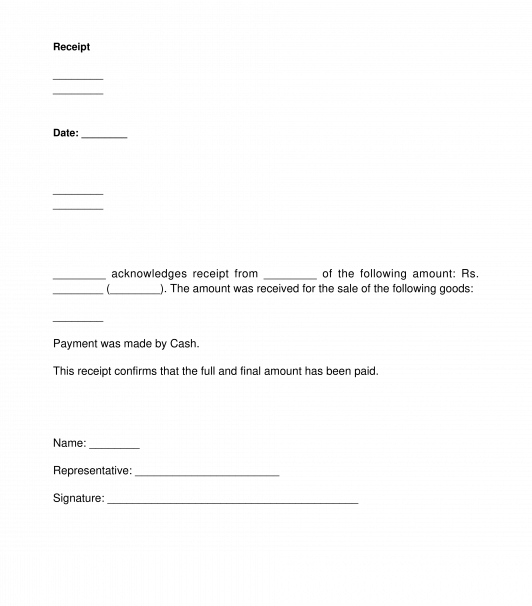

A General Receipt, often known as just a "Receipt," is a document by which one party can evidence that they received something from another party. Receipts are most often used in situations of sale, like a sale of goods or sale of services. They can also be used for documents and monetary transactions generally (such as the fulfilment of a debt or other obligation) as well as donations.

If a Rent Receipt is desired, that is a separate document which can be found here.

Receipts are generally pretty simple and only really need basic information about the transaction between the parties.

How to use this document

This document can be used for any type of Receipt. The document is set up to assist the form-filler with the most common types of Receipts: Monetary Receipts, Document Receipts, Goods Receipts, Services Receipts, or Donation Receipts. If none of these are the correct categorization, the Receipt also has an option for "Other," whereby the form-filler can enter the details of the transaction underlying the receipt.

Here, the form-filler will enter the name and address information for each party and then choose the type of Receipt. From there, additional details will be asked about the transaction to help fill the receipt out.

Afterwards, the document should be signed by the individual accepting receipt - whether it is accepting receipt of money, documents, goods, etc. Then, ideally, a copy should be kept with both parties with the original going to the individual who did not sign it.

Applicable law

There are some restrictions on the mode of payment and receipt under the Income Tax Act, 1961. In terms of the said Act, (other than the exceptions specified) no person shall receive an amount of two lakh rupees or more (a) in aggregate from a person in a day; or (b) in respect of a single transaction; or (c) in respect of transactions relating to one event or occasion from a person, otherwise than by an account payee cheque or an account payee bank draft or use of electronic clearing system through a bank account. Further, the Indian Stamp Act, 1899 requires a receipt to be given on demand and also requires that a revenue stamp be affixed on receipts over an amount of Rs. 5000 (Rupees Five Thousand).

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

General Receipt - Sample, template - Word & PDF

Country: India