03-11-2025

03-11-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

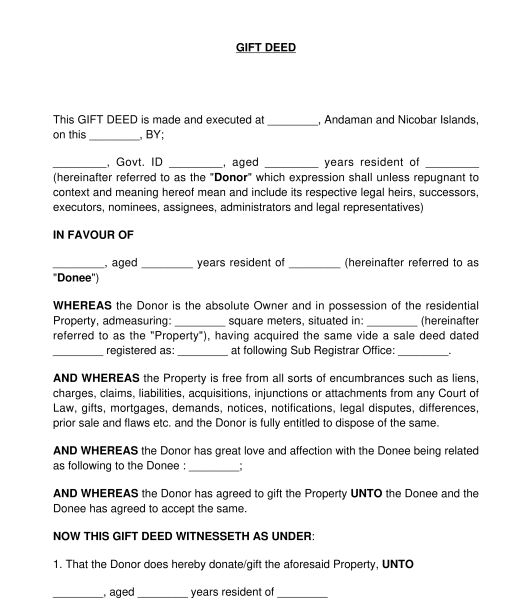

A Gift Deed is a document through which a person or persons (i.e. a donor) can transfer its property to another person or persons (i.e. donee) by way of the gift without payment of any money or other consideration. A Gift Deed can be used when a person, being a valid owner of an existing property, wishes to gift his property to someone.

The property or assets under a Gift Deed include real estate, movable property, or other valuable assets. It is commonly used in scenarios such as gifting property to a family member or donating assets to a charitable organization.

A Gift Deed is different from that of a Will. Under the Gift Deed, the ownership of the property or assets is transferred during the lifetime of the donor. On the other other hand, under will the ownership will only be transferred after the death of the donor. Unlike a Gift Deed, the Will can be amended by the donor during their lifetime.

Yes, Having a written Gift Deed is mandatory if the gift involves the transfer of immovable properties such as buildings or land. Even if it doesn't involve immovable properties, having a written Gift Deed can help establish clear terms and act as legal evidence to protect the rights of each party.

The following things are not allowed in a Gift Deed:

The donor must be above 18 years of age or any registered entity in India. The donor must act voluntarily and not be under the influence of coercion, alcohol, drugs, or any other influence. A donee can be a person or entity registered in Indian including a minor.

A Gift Deed is typically executed as a one-time transfer and does not have a duration. Once the Gift Deed is executed and registered, it cannot be revoked or cancelled unless there is some illegality involved.

The Gift Deed would need to be printed on non-judicial stamp paper or e-stamp paper, which is available in certain states. The value of the stamp paper would depend on the state in which it is executed and where the property is situated. Each state in India has provisions in respect of the amount of stamp duty payable on the Gift Deed, and the same would need to be determined based on the specific facts of the case. Information regarding the stamp duty payable can be found on the State government websites.

After printing the document on stamp paper or e-stamp paper, as applicable, the Gift Deed is to be signed and each party can keep a copy of the Gift Deed.

No, it is not mandatory. However, notarizing the document will add an extra layer of protection.

Yes, the Gift Deed involving immovable property must be registered with the local sub-registrar where the property is located.

Yes, the Gift Deed must have at least two witnesses above the age of 18 years to register it. It is recommended to have two witnesses to support the document in case of any legal disputes in the future.

Yes, under certain circumstances the Gift Deed can be terminated including when the gift was not made voluntarily or using some force or coercion. Any other condition which makes a contract invalid also applies to a Gift Deed.

A Gift Deed must contain the following clauses:

The provisions of the Transfer of Property Act, 1882 are applicable to gifts of immovable property. In terms of the Transfer of Property Act, 1882 read with the Registration Act, 1908 all Gift Deeds of immovable property are compulsorily registrable.

The provisions under the Indian Contract Act 1872 and the Income Tax Act, 1961 would also be applicable.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: What to do after Finishing a Contract?

Gift Deed - Template, online sample - Word & PDF

Country: India