05-11-2025

05-11-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

05-11-2025

05-11-2025

Word and PDF

Word and PDF

14 to 21 pages

14 to 21 pages

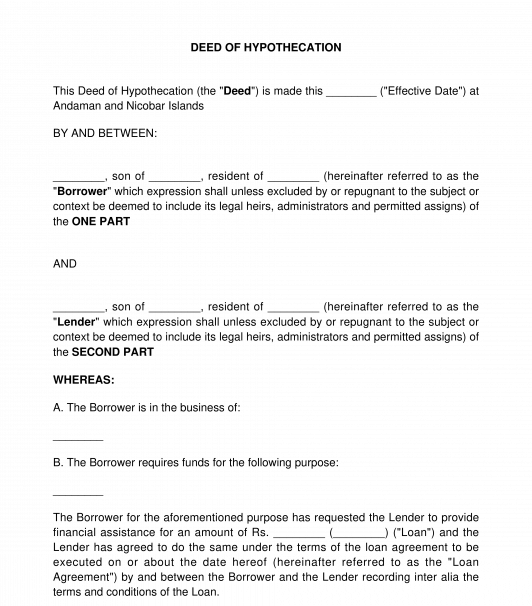

A loan can be secured or unsecured, i.e. the borrower can provide the lender with security towards repayment of the loan. In the event of failure by the borrower to repay the loan amount, the lender can invoke the security and use it to recover its money.

Hypothecation means offering an asset as collateral security to the lender. Herein, the ownership lies with a lender and the borrower enjoys the possession. In the case of default by the borrower, the lender can exercise his ownership rights to seize the asset.

Hypothecation Deed is used in the case of movable assets, for creating the charge against collateral for the loan given. Under hypothecation, the possession of the security remains with the borrower itself. Hence, if the borrower defaults on payments, the lender will have to first take possession of the security (asset under hypothecation) and then sell the asset to recover dues.

Whether the loan is between friends and family or is a commercial loan between two businesses for a specific purpose, options in this Hypothecation Deed will allow making collateral of movable assets against a loan obtained.

Under a Hypothecation, only movable assets are kept as a security, but under a loan agreement, the security can be either movable assets or immovable assets. Under the Hypothecation Deed, both the possession and ownership of the rest with the borrower.

How to use this document?

The parties should carefully read this document. The Deed of Hypothecation will be legally binding when it has been printed on a non-judicial stamp paper or e-stamp paper and signed by each party and has been dated. The value of the stamp paper would depend on the state in which it is executed. Each state in India has provisions in respect of the amount of stamp duty payable on such agreements. Information regarding the stamp duty payable can be found on the State government websites. For e.g., the State of Karnataka and the State of Madhya Pradesh.

Each Party should sign and return a copy of the Hypothecation Deed. Individuals should ensure that their signature on the document is witnessed by another adult person (over the age of 18).

Where a company is a party to this agreement, they should ensure that the Hypothecation Deed is signed by an authorised signatory, which is usually a director as authorised by a board resolution of the company.

Each Party should keep a signed copy of the Hypothecation Deed. In order to do this, two different copies can be signed, or if only one copy is signed, it can be photocopied and then distributed between the parties.

Applicable laws

This agreement is subject to the broad principles of contract law.

The Companies Act, 2013 regulates the giving of loans, guarantees, or security by companies to their directors (whether directly or indirectly).

Banks are required to comply with directions issued by the Reserve Bank of India regarding interest rates that can be charged by them.

Movable property (e.g. assets, machinery etc.) can be created by way of hypothecation and execution of a deed of hypothecation.

Another type of security that is often provided is the creation of charges on financial instruments such as shares of a company, which would require compliance with the provisions of the Companies Act, 2013. Section 172 of the Contract Act 1872 provides for a pledge over tangible movable assets as a bailment of goods as security for payment of any outstanding debt.

In case of a charge being created by a company over property or instruments such as its shares, the filing must be made with the Registrar of Companies, regarding the creation of the charge.

How to modify the template?

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: What to do after Finishing a Contract?

Hypothecation Deed - Sample, template - Word & PDF

Country: India