09/11/2025

09/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

09/11/2025

09/11/2025

Word and PDF

Word and PDF

20 to 28 pages

20 to 28 pages

A Share Purchase Agreement is a legally binding contract established during the buying or selling of shares in a company. It should clearly outline the terms and conditions, including the details of what is being sold, to whom, and at what price, along with any associated obligations, risks, and liabilities.

The goals of the share purchase agreement are to facilitate the ownership of shares to the buyer and to protect the interests of all parties involved, ensuring a clear understanding of their rights and responsibilities in the share transfer process.

A Share Purchase Agreement is commonly used in mergers and acquisitions when a buyer acquires a company by purchasing its shares, or in private equity transactions during investments or acquisitions. Additionally, it can be applied in family business successions to transfer shares between generations.

Asset Purchase Agreement: An asset purchase agreement is a legal contract that sets out the terms and conditions relating to the sale or purchase of a company's assets or liabilities.

Merger Agreement: A merger agreement is a legal document that provides the terms and conditions of a merger, detailing how the companies involved will combine and manage the assets and liabilities between them.

When a company's shares are purchased, the buyer's goal is to gain partial or full control of the business. Therefore, a Share Purchase Agreement differs from an Asset Purchase Agreement, which is a contract where the buyer acquires only specific assets (and sometimes certain liabilities) of the company, without gaining ownership or control of the company itself.

A Merger Agreement is a legal contract that defines the terms and conditions under which two companies combine into a single entity, specifying how their assets and liabilities will be managed. Unlike a share purchase, where the company's structure remains intact but ownership levels change, a merger always results in the full joining of both entities into one.

No, it is not legally required to have a share purchase agreement. However, it is recommended as the Companies Act 2006 mandates proper documentation and record-keeping of share transactions.

Individuals such as private investors and entrepreneurs can enter into a share purchase agreement when buying or selling shares. Companies may also use share purchase agreements when acquiring shares in another company, for example, during an expansion or strategic acquisition. Private equity firms also utilise share purchase agreements to purchase controlling or minority stakes in businesses, while venture capitalists utilise them when investing in start-ups or early-stage companies.

After completing due diligence and finalising the Share Purchase Agreement, the buyer, or both parties, will seek the necessary consents and approvals to fulfil any conditions outlined in the share purchase agreement.

Once all conditions are met, the final step is the transfer of shares. The parties will submit the share transfer form and file the required documentation with Companies House, officially transferring ownership to the buyer as part of the sales transaction.

No, witnesses are not legally required for a Share Purchase Agreement as long as it is signed by both the buyer and seller. However, in certain cases, witnesses may be necessary. For instance, if the agreement is executed as a deed rather than a simple contract, witnesses will be required, as UK law requires that deeds must be witnessed.

A share purchase agreement should contain:

Contracts (Rights of Third Parties) Act 1999

Financial Services and Markets Act 2000

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: Signing Documents in England and Wales

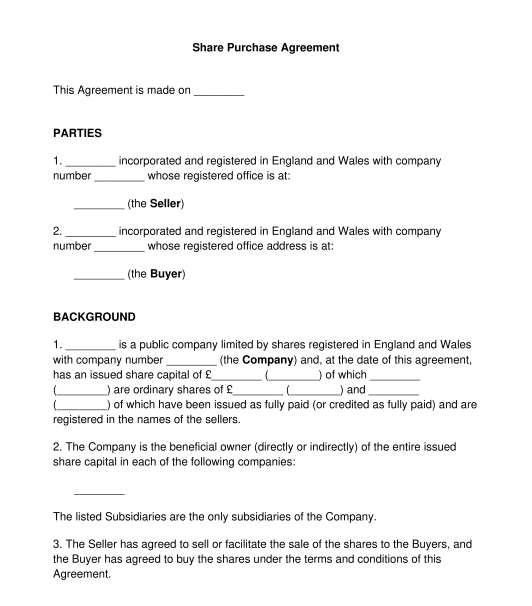

Share Purchase Agreement - Template - Word & PDF

Country: United Kingdom