09/30/2025

09/30/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

09/30/2025

09/30/2025

Word and PDF

Word and PDF

13 to 18 pages

13 to 18 pages

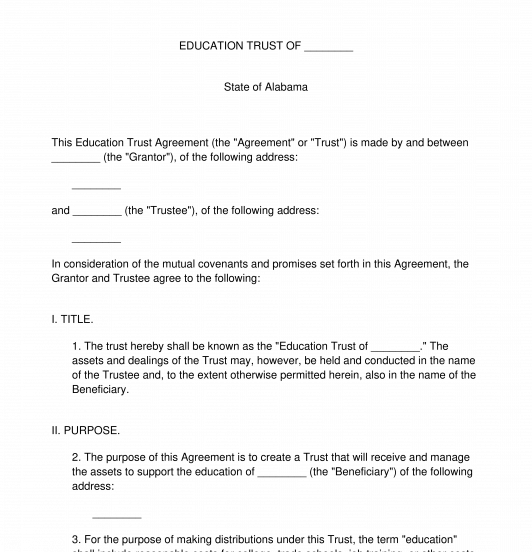

An Education Trust Agreement is a special type of trust under Section 2503(c) of the Internal Revenue Code whose main purpose is accumulating funds to pay for the higher education of a child. Often established by parents or grandparents, Education Trusts allow them to save up money to pay for future education while having the earnings on those funds taxed to their children at a lower income tax rate without having to give up control over the use of the funds. Often, the funds are taxed at a lower rate than the normal income tax rate of the person who created the Trust. This sort of Trust is especially useful since it can be used to control exactly how the money is spent, with a designated Trustee controlling the pay out of the money so the Beneficiary does not have direct access to the funds.

A Trust is a fund that holds a person's assets with rules about how and when the funds will be released and with a third-party managing those funds. All Trust funds have three main people involved:

An Education Trust is similar to any other sort of Trust with its main difference being that the funds are specifically set aside to pay for education. A Living Trust, by contrast, is a fund created where the Grantor is also the Beneficiary and the trust funds are used for the Grantor's benefit. Creating an Education Trust can be a prudent way to plan for a child's future while maintaining control and providing safeguards so that the money is not squandered or mismanaged.

How to use this document

1. Specify the purpose of the Trust --

One of the most crucial parts of the Trust Agreement is specifying the purpose of the Trust. This involves naming a Beneficiary who will receive funds from the Trust to support their education. Usually the Beneficiary is the Grantor's child or grandchild, but this is not a requirement. The Beneficiary just must be a person under the age at which the Trust is set to terminate. Only one Beneficiary may be named in an Education Trust Agreement. So, if someone would like to provide for multiple children, they must make multiple Trust Agreements. The Grantor is also able to set requirements about how the Trust funds may be spent. They can explain what qualifies as "education" under the meaning of this Agreement. For example, they could state that the funds may only be used to pay for tuition at specific schools or to support particular courses of study.

2. Appoint a Trustee --

The Grantor must appoint a Trustee in the Trust Agreement. The Trustee is in charge of managing the Trust assets, making payments of the Trust income to the Beneficiary, and making sure that the Trust is properly terminated when the Beneficiary reaches a pre-determined age. The main requirements of a Trustee are that they are an adult 18 years or older and that they have not been convicted of a felony. Often, a Grantor serves as their own initial Trustee and then names a successor Trustee to assume the role once the Grantor becomes disabled, no longer wishes to manage the Trust, or dies.

3. Describe the Trust Assets --

The Grantor should describe in as much detail as possible the assets they plan to transfer into the Trust. This description should include details such addresses of real estate, visual descriptions of personal property (e.g. a grand piano, a 2 carat diamond ring, etc.), and the value of any and all assets included in the Trust. The Grantor should then prepare to do the work of transferring these assets using forms such as a Bill of Transfer for the transfer of any tangible personal property, a Trust Letter to a Bank for the transfer of the contents of a bank account, broker forms for the transfer of stocks and bonds, and a Change of Beneficiary document for the transfer of a life insurance policy.

4. Name Successor Trustees and Beneficiaries --

A successor Trustee should be designated to provide for the possibility that the initial Trustee will be unable or unwilling to serve as trustee in the future (e.g., resignation, poor health). One of the requirements of the Trust is that the Trust assets must be distributed to the Beneficiary's estate, if the beneficiary dies before reaching age at which the Trust is set to terminate. As an alternative, the trust assets can be distributed to other beneficiaries that the Beneficiary designates in the Beneficiary's will or in the Trust Agreement itself.

Once the Grantor has completed their Trust Agreement and thoroughly reviewed it to make sure that their wishes are accurately reflected, the Grantor and Trustee should each sign and date the Agreement in front of three witnesses. The witnesses should also sign the Agreement, attesting that the Grantor was of sound mind and had the capacity to make these decisions when they signed the Trust Agreement. The witnesses should all be 18 years old or older. In addition, the Grantor should number and initial the bottom of each page of the Agreement. Finally, the Agreement includes a page for a notary to notarize to add an extra level of precaution.

Once the Trust Agreement has been signed and completed, it should be put somewhere for safekeeping, such as in a home safe or a bank safety deposit box. The Grantor may also give copies of the Agreement to people with whom they are close and that they trust, such as a spouse or their children. Finally, the Grantor should go through the process of transferring the assets described by the Trust Agreement into the Trust.

Applicable law

The creation and interpretation of Education Trusts are a matter of both state and federal law. According to federal tax law, this trust is not appropriate for estates (including life insurance proceeds and retirement plans) which exceed the federal estate tax applicable exclusion amount ($5,200,000.00). Section 2503(c) of the Internal Revenue Code outlines the specifics of Education Trust Agreements and explains how the assets in this sort of Trust shall be taxed.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Education Trust Agreement - FREE - Sample, template

Country: United States