11/02/2025

11/02/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.8 - 252 votes

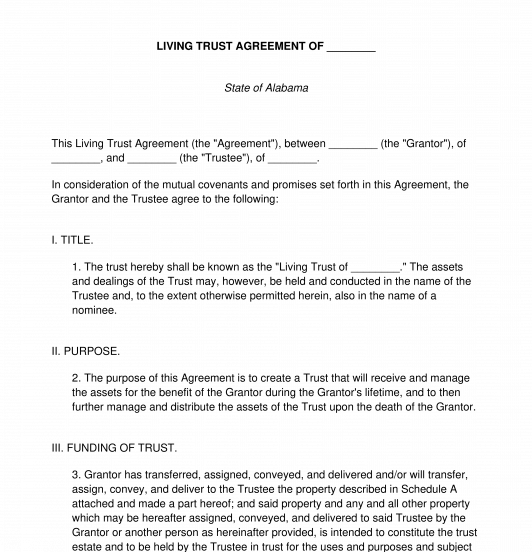

Download a basic template (FREE) Create a customized documentA Living Trust, also known as a Revocable Trust, is an Agreement created by a person, known as the Grantor, to hold some portion of their assets during their lifetime. The Trust provides for payment of income to the Grantor and the distribution of the remaining Trust assets once the Grantor dies. The person in charge of managing the Trust is known as the Trustee. The Trustee can be the Grantor themselves, a bank, or some other third party that the Grantor feels confident will be able to responsibly manage the assets of the Trust. Most Trusts provide that the Grantor will serve as the initial Trustee to manage the assets of the Trust until the Grantor becomes disabled, would prefer to have another party manage their affairs, or dies. At this time, a new individual, known as the successor Trustee will step in to manage the Trust and make distributions as necessary and appropriate. A Revocable Living Trust also allows for the Grantor to amend or revoke the Trust at any time by providing to the Trustee appropriate written amendments or restatements signed by the Grantor.

During the Grantor's lifetime, they will receive payments of the net income of the Trust at pre-determined intervals. Once the Grantor dies, the Trust designates who will receive the assets from the Trust, similar to a Will. These distributions can be specific gifts to individual beneficiaries, such as an amount of money to charity or a favorite piece of jewelry to a child. The distributions can also be the residue, or the remaining assets not given away as specific gifts, such as all of the Grantor's remaining personal property included in the Trust. The Trustee is responsible for administrating the Trust and making the distributions as described in the Trust Agreement.

Though a Living Trust is similar to a Will, there are several key differences. Many people find a Living Trust to be a preferable alternative to a Will because of three main advantages:

1. Privacy - Living Trusts are more private than Wills because, under state law, a Will is admitted to a court procedure known as probate where the court determines the validity of the Will, deals with potential challenges, and distributes the assets to beneficiaries. As a result, the contents of the Will become part of the publically searchable and accessible court records. By contrast, a Living Trust is generally administrated by the Trustee without court interference or involvement, and so does not become a part of public record.

2. Lower cost - Living Trusts usually cost less to maintain and administrate. When a Will goes through probate, it is often tied up in the court process for as long as three years and involves court costs, lawyer fees, executor fees, and other assorted expenses. Since a Trust is generally administrated without court involvement, using a Trust can help someone avoid incurring the expenses associated with a Will.

3. Property management - A Living Trust allows a Grantor to name a person or organization to manage the assets they choose to include in the Trust if they become unable to do so or no longer wish to do it themselves. In this way, a Living Trust can be used as an alternative to a conservatorship or a guardianship.

Key Terms:

How to use this document

Use this document to explain how the Grantor's Trust should be managed while they are alive and then distributed among the people they name once they die. There are several major details that the Grantor must include in the Trust Agreement to accomplish this task.

1. Describe the Grantor's Family --

The Grantor should note whether they are married and, if so, the name of their spouse, as well as whether they have any children. For the purposes of a Trust Agreement, children include both those that were born to the Grantor as well as those that have been legally adopted by the Grantor. This Agreement also includes a provision so that the Grantor's future children, if any, are covered by the terms of this Trust Agreement. All children should be included in the family description, even if the Grantor does not plan to leave them anything in the Trust. This way, a Judge can be sure that the Grantor meant to disinherit a child and did not mistakenly overlook them in this Agreement.

2. Appoint a Trustee --

The Grantor must appoint a Trustee in the Trust Agreement. The Trustee is in charge of managing the Trust assets, making payments of the Trust income to the Grantor, and making sure that the people the Grantor has named as beneficiaries get the portion of the Trust described by the Grantor after the Grantor's death. The main requirements of a Trustee are that they are an adult 18 years or older and that they have not been convicted of a felony. Often, a Grantor serves as their own initial Trustee and then names a successor Trustee to assume the role once the Grantor becomes disabled, no longer wishes to manage the Trust, or dies.

3. Describe the Trust Assets --

The Grantor should describe in as much detail as possible the assets they plan to transfer into the Trust. This description should include details such addresses of real estate, visual descriptions of personal property, and the value of any and all assets included in the Trust. The Grantor should then prepare to do the work of transferring these assets using forms such as a Bill of Transfer for the transfer of any tangible personal property, a Trust Letter to a Bank for the transfer of the contents of a bank account, broker forms for the transfer of stocks and bonds, and a Change of Beneficiary document for the transfer of a life insurance policy.

4. Name Beneficiaries --

One of the most important parts of a Trust is the Grantor naming their beneficiaries. The beneficiaries are the people who will inherit the contents of the Grantor's Trust after the Grantor's death. The Grantor may make specific gifts in their Trust Agreement, naming specific people to inherit specific possessions, property, or cash assets. For example, a mother might make a specific gift leaving her engagement ring to her eldest daughter or a father might make a specific gift leaving $5,000 to each of their children to help them pay for their college education.

In addition to specific gifts, the Grantor must also name who will inherit the residue, or remainder, of their Trust. The residue includes anything that they have not given away in a specific gift. The Grantor will name beneficiaries as well as alternate beneficiaries in case the people they have initially named die before them and are therefore unable to inherit. The Grantor can name multiple people to inherit the residue of their Trust. and may specify what percentage or fraction of the Trust each beneficiary will get.

Note: In Texas and Wisconsin, exercise caution before designating the Grantor as the sole Trustee and the sole lifetime beneficiary. In those states, the Trust may be considered "void" where all three interests -- grantor, trustee, and beneficiary -- "merge" and therefore the Trust has no legal significance.

Once the Grantor has completed their Trust Agreement and thoroughly reviewed it to make sure that their wishes are accurately reflected, the Grantor should sign and date the Agreement in front of three witnesses. The witnesses should also sign the Agreement, attesting that the Grantor was of sound mind and had the capacity to make these decisions when they signed the Trust Agreement. The witnesses should all be 18 years old or older. In addition, the Grantor should number and initial the bottom of each page of the Agreement. Finally, the Agreement includes a page for a notary to notarize to add an extra level of precaution.

Once the Trust Agreement has been signed and completed, it should be put somewhere for safekeeping, such as in a home safe or a bank safety deposit box. The Grantor may also give copies of the Agreement to people with whom they are close and that they trust, such as a spouse or their children. Finally, the Grantor should go through the process of transferring the assets described by the Trust Agreement into the Trust.

Applicable law

The creation and interpretation of Living Trusts are a matter of both state and federal law. According to federal tax law, this trust is not appropriate for estates (including life insurance proceeds and retirement plans) which exceed the federal estate tax applicable exclusion amount ($5,200,000.00).

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Living Trust Agreement - FREE - Template - Word and PDF

Country: United States