10/31/2025

10/31/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/31/2025

10/31/2025

Word and PDF

Word and PDF

6 to 10 pages

6 to 10 pages

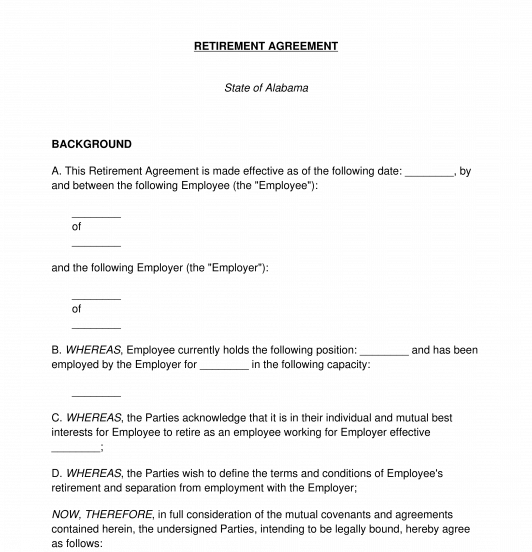

A Retirement Agreement is a document used when an employee wishes to voluntarily leave their job working for their employer and retire from the workforce. The document is used to settle the rights and obligations of both the employee and the employer, both in the period before the employee's retirement date as well as after they are officially retired. The Retirement Agreement covers key details such as the retirement date, severance benefits, reimbursement for accumulated vacation or sick days, and mutual non-disparagement of the parties involved. Although information about retirement benefits is sometimes included in an Employment Agreement, having a separate Retirement Agreement allows the parties to go more in-depth and can be especially useful if the Employment Agreement does not address this issue.

By creating a Retirement Agreement, the employee can be assured that they will receive benefits that will help them maintain security in the future once they are no longer working, while the employer can know that the employee will adhere to the obligations set out for them and that their separation from work is a smooth and easy transition for both parties. Retirement benefits are often paid to a former employee for years after they have retired from their job, so it is crucial that the parties make their expectations clear to avoid misunderstandings or disputes later on down the line.

How to use this document

This document covers all of the important information necessary for an employee and an employer to settle the rights and obligations of the parties when the employee retires from their job, including:

The employee and employer can discuss the terms of the Agreement and create and sign the final Agreement at any time prior to the employee officially retiring from their job. This Agreement can also be created after the employee has retired for the purpose of clarifying and formalizing the relationship between the parties and describing the responsibilities of all involved parties. After inputting the required information, this Agreement is printed out and signed by both Parties, and then kept on file by both parties for the duration of the Agreement as well as for a reasonable period of time thereafter.

Applicable law

Retirement Agreements, and other contracts related to employment, in the United States are subject to both Federal laws and specific state laws. For example, the federal Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA), allows a person to continue receiving the exact same health coverage they've been getting from their employer after they leave the company, as long as they're not covered by another plan elsewhere. COBRA covers most private sector and state or local government employers with 20 or more employees. Most states also have laws similar to COBRA that cover companies with fewer than 20 employees. State laws may also define and restrict how employers can protect themselves if an employee tries to take their clients or use confidential information.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Retirement Agreement - FREE - Template - Word & PDF

Country: United States