10/31/2025

10/31/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/31/2025

10/31/2025

Word and PDF

Word and PDF

1 page

1 page

A Credit Card Statement Inquiry Letter is used by a credit cardholder to ask that their credit card company look into an issue or problem that must be corrected on their credit card statement. Identity theft, credit card skimming, and other forms of credit fraud are all too common. These can lead to unfamiliar or suspicious charges that show up on a credit card statement. Further, businesses can sometimes mistakenly charge a card multiple times for the same transaction, causing duplicate charges to show up on the cardholder's statement. One way to rectify these issues is to send the credit card company a Statement Inquiry Letter alerting them to the issue and asking that they look into the incorrect or unfamiliar charges.

The sooner the company receives notice that there is an issue with the credit card statement, the sooner they can take steps to remedy the mistake and make sure that the person's credit is not affected by unauthorized, incorrect, or duplicate charges. A Credit Card Statement Inquiry Letter can help the cardholder take care of this issue efficiently while also creating a record of contact with the credit card company showing that they were put on notice in case of future dispute.

How to use this document

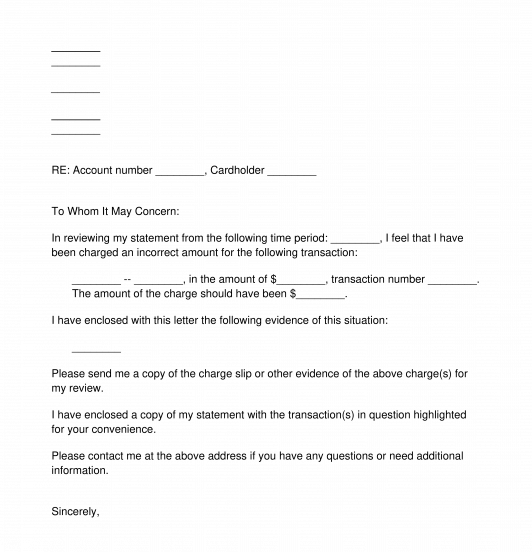

This document includes all of the information a cardholder would need to communicate with their credit card company that there is an issue that must be investigated and corrected on their credit card statement.

The cardholder must first provide identifying information, including their name, address, and account number, that the credit card company can use to confirm that they are the owner of the account in question and to locate their files. The cardholder should then specify why they are contacting the company. They are able to contact the credit card company for a number of issues such as duplicate charges, unauthorized charges, an incorrect charge amount, or any other problems related to their credit card billing statement. The cardholder can then provide information specific to their inquiry, including the time period of the statement on which the issue occurred, the transaction number(s) of the charge(s) in question, the business responsible for the charge(s), and other related details. The cardholder can also choose to include enclosures with their letter such as a copy of the credit card billing statement in issue, transaction slips, or a police report of the identity theft. Finally, the cardholder can request that the credit card company provide them with proof of transaction(s) in question.

Once the cardholder provides all of the necessary information, they should sign and date the letter and then send it to their credit card company, along with copies of any supporting documentation or credit card statements, using a secure method. By using a secure method, such as certified mail, the cardholder will have documentation that their request successfully made it to the credit card company and when it was received by them in case of future dispute.

Applicable law

There are no laws outlining exactly what must be put into a Credit Card Statement Inquiry Letter. There are, however, some generally accepted practices for creating such documents, including making sure the information and supporting documentation is robust enough for the credit card company to identify and rectify the issue with the billing statement.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Credit Card Statement Inquiry Letter - FREE - Template

Country: United States