10/31/2025

10/31/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/31/2025

10/31/2025

Word and PDF

Word and PDF

1 page

1 page

A Credit Freeze Request Letter is a letter that can be sent to a credit reporting agency asking that access to a credit report be restricted. A credit freeze restricts access to a person's credit report. Without this access, it is significantly more difficult for identity thieves to open new lines of credit in the person's name. This is an especially effective tool to use if someone does not plan to use their credit for a period of time, as this complicates the process. Once the person would like to use their credit again, by getting a new credit card, loan, or mortgage, for example, they can then send a letter asking that their credit be unfrozen while also providing proof of their identity.

Unfortunately, identity theft is rampant in this day and age. However, there are measures that a person can take to protect their credit and remedy an identity theft situation. If someone is a victim of identity theft who wants to protect their credit or someone who wants to prevent others from using their credit information, a Credit Freeze Request Letter can help them do that. Credit freezes are also important tools that can be used to protect the identity and credit of people who are especially vulnerable and unlikely to open credit accounts themselves, such as children, the elderly, or those living with developmental disabilities.

How to use this document

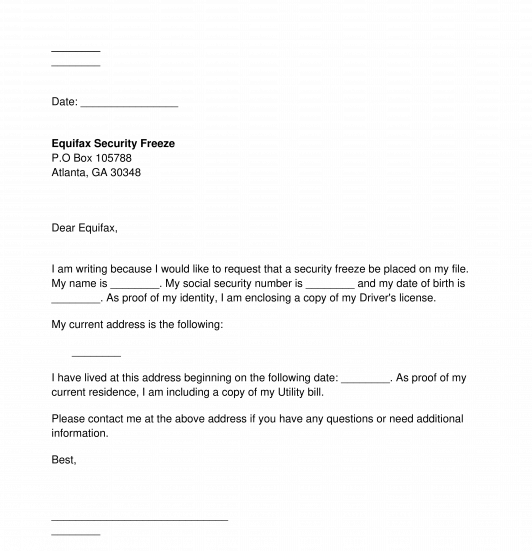

This document includes all of the information someone would need to ask that a credit reporting agency place a credit freeze on their account. They should first provide identifying information, including their name, address, birthdate, and social security number. They should then be prepared to provide proof of their identity, such as copies of a driver's license, state-issued identification, passport, or other official identity documentation. They should also provide proof of their address, using copies of documents such as utility bills, bank or mortgage statements, property titles, or other similar documentation that would prove their residence. If they have a police report documenting that they were the victim of identity theft, this can also be included to further support their request to the credit reporting agency.

After providing this basic information, the person requesting that their credit be frozen should send this signed and dated letter, along with the necessary proof and documentation, to the credit reporting agency using a secure method. By using a secure method, such as certified mail, the person will have documentation that their request successfully made it to the agency and when it was received by them in case of future dispute or issues.

Applicable law

Identity theft and credit reporting are the subject of both state and federal laws that govern how these issues are handled. According to the Economic Growth, Regulatory Relief, and Consumer Protection Act, a federal law passed in 2018, it is unlawful for any credit reporting agency charge for a credit freeze or thaw, regardless of which state the person making the request lives in.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter

Credit Freeze Request Letter - FREE - Sample, template

Country: United States