10/31/2025

10/31/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/31/2025

10/31/2025

Word and PDF

Word and PDF

1 page

1 page

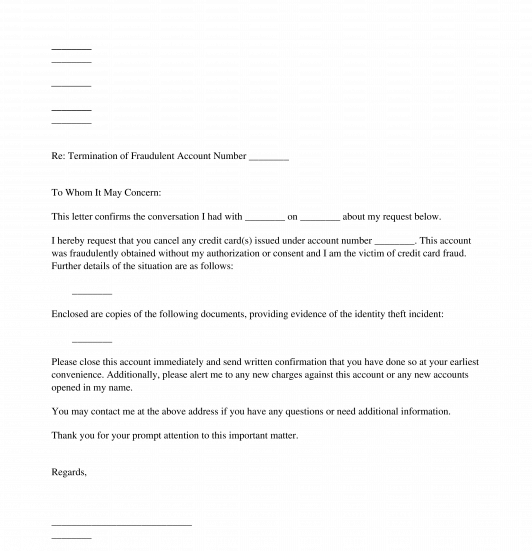

A Cancellation of Fraudulent Credit Card Request is a letter used by a cardholder to alert a credit card company that an unauthorized credit card has been taken out in their name and to request the cancellation of that card.

Unfortunately, identity theft and credit card fraud are all to common in this day and age. Identity thieves are able to use other people's social security numbers and identity information to open unauthorized credit card accounts in their names, leaving the victim responsible for paying all of the charges they incur on the account before their fraud is discovered. Once a person discovers that an unauthorized credit card has been taken out in their name, they can send a letter to the credit card company to alert them to the issue and have the card cancelled. This is vitally important as it both stops the identity thief from incurring anymore charges while also acting as written proof that the credit card company was contacted about the issue. This proof can be used to clear up any problems and make sure that they are not responsible for any future charges on the unauthorized card.

This document is specifically for canceling an unauthorized credit card in the event of some sort of identity theft. To cancel an authorized credit card, use a Request to Cancel Credit Card form.

How to use this document

This letter includes all of the information necessary for a person to alert a credit card company that an unauthorized credit card has been taken out in their name and to request that the credit card be cancelled.

The person must first provide identifying information, including their name, address, and the account number for the unauthorized card. This information will be used by the credit card company to confirm that their name is connected to the account and to find the relevant files in their system. The person can also specify whether this letter is a follow up to a prior phone call they made to the credit card company regarding this identity theft and credit card fraud issue. While a phone call is the fastest way to alert the company to an issue, it can also be prudent to send a follow up letter as well so that there is written documentation of the contact. If the person has been in contact with the credit card company, they can then provide the name of the representative and the date that they contacted the company. The person should then provide a detailed description of the credit card fraud situation. The credit card company will likely have questions about the request and want to verify the truth of the claims that the person making the request did not authorize the credit card. So, providing details about the circumstances under which the person making the request became aware of the unauthorized card and other actions they have taken to remedy the situation could be persuasive to the company. Finally, the person can indicate whether they will be enclosing additional evidence, such as a police report or an Affidavit of Identity Theft, along with this letter.

Once the person making the request provides all of the necessary information, they should sign and date the letter and then send it to the credit card company, along with copies of any supporting documentation or credit card statements, using a secure method. By using a secure method, such as certified mail, the person will have documentation that their request successfully made it to the credit card company and when it was received by them in case of future dispute.

Applicable law

There are no laws outlining exactly what must be put into a Cancellation of Fraudulent Credit Card Request letter. There are, however, some generally accepted practices for creating such documents, including making sure the information and supporting documentation is robust enough for the credit card company to be persuaded that the person asking that the credit card be canceled is telling the truth and to then remedy the situation promptly and efficiently.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Cancellation of Fraudulent Credit Card Request - FREE

Country: United States