01/10/2025

01/10/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

01/10/2025

01/10/2025

Word and PDF

Word and PDF

1 page

1 page

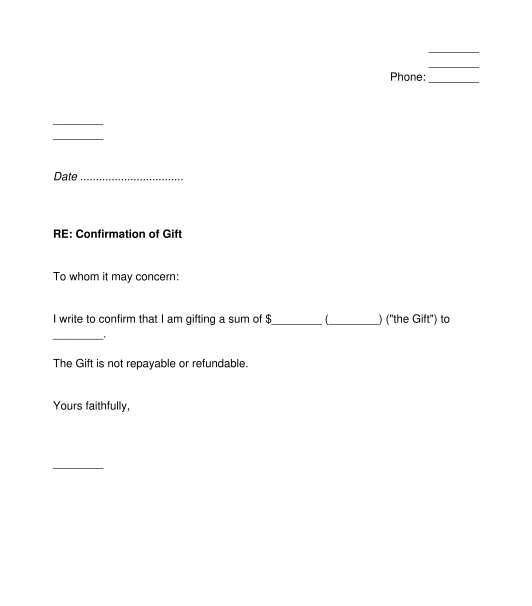

A Letter to Lender Confirming Gift or Loan can be provided to a bank or other lender, to help with a loan application. Often, if a person has received a sum of money from someone else, then the bank/lender will want to know if the money was a gift, or if it was a loan that needs to be paid back. This will be taken into account by the bank when considering a loan application.

For example, it is often used when parents have given money to a child, to enable the child to purchase a house. The child may then go to a bank to seek a loan, and the bank may ask for confirmation of whether the money from the parents was a loan (which needs to be repaid in future) or a gift (which will not need to be repaid). In many cases, if the money from the parents was a gift, the child may be more likely to be approved for a loan, and may be able to borrow more money from the lender.

The letter can be used in either case (whether the money is a gift or a loan). It can also be used to provide further details about the money, for example any applicable interest rate (if it was a loan), and the purpose for which it was provided.

No, but if the bank asks a loan applicant about some money they have received, and the applicant does not provide a letter, then this could jeopardise the loan application.

The letter should not include false or misleading information. In particular, it should not state that a sum of money is a gift if it was really a loan. A bank may rely on the information contained in this document to decide whether or not to provide a loan.

Providing a false or misleading document with a loan application could amount to fraud and could lead to significant penalties.

This letter involves several parties, including:

Once the document has been prepared and signed by the Sender, it may be provided to the bank or lender. In many cases, the Sender may actually sign it and provide it to the Recipient (the person they provided the money to in the first place), so that the Recipient can provide it to their bank/lender.

Both the Sender of the letter and the Recipient may keep a copy of the document for reference.

The letter should contain:

There are no laws in particular that apply to a Letter to Lender Confirming Gift or Loan. However, the National Consumer Credit Protection Act 2009 (Cth), and in particular the National Credit Code, which appears in schedule 1 of that Act, deals with consumer credit in Australia.

Further information and guidance can also be obtained from the Australian Securities and Investments Commission ("ASIC") and from ASIC's Moneysmart website.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Letter to Lender Confirming Gift or Loan - template

Country: Australia