11/12/2025

11/12/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

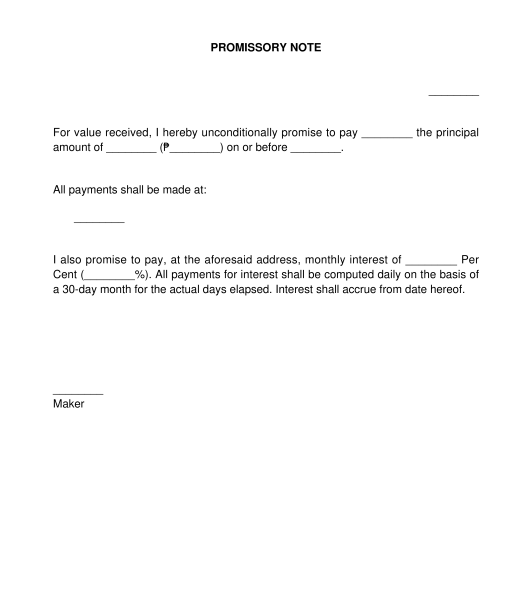

A Promissory Note is an unconditional promise in writing made by one person (the "maker") in favor of another (the "payee") that the maker will pay an amount of money at a specified date. It must be signed by the maker and delivered to the payee. If any of the following is absent in a Promissory Note, then it is invalid:

The Promissory Note is payable to the order of the payee if the payee can transfer the Promissory Note (by indorsement) to another, on the other hand, it is payable to the order of the maker if the maker names a payee who will be paid the sum of money under the Promissory Note.

While a Promissory Note and a Loan Agreement are similar in the sense that a person is obliged to pay a certain amount on a specified date. A Loan Agreement lays down the terms and conditions of the agreement between the person who owes money called the debtor and the person who is owed money called the creditor. On the other hand, a Promissory Note lays down that the person called the maker, will make an unconditional promise to pay a certain amount at a specified date.

The distinction lies in the fact that a Promissory Note has a technical meaning and usage and can be indorsed or transferred in favor of another in the same manner as checks, which means it is a mode of payment. On the other hand, a Loan Agreement does not have such features and only lays down the terms and agreement of the debtor and creditor.

In effect, the debt under a Loan Agreement can be paid using a Promissory Note if the debtor and creditor agree thereto.

A Promissory Note will state that a person will pay an amount of money to another on a specified date. On the other hand, an Acknowledgment Receipt will state that a person has received an amount of money or goods from another person.

In effect, a Promissory Note may be written and signed by the maker to pay an amount of money, and once the payee receives the said amount, then he can issue an Acknowledgment Receipt to establish that the maker has already paid the amount.

A Promissory Note contains the following information:

Note that the interest rate should not be excessive. Whether an interest rate is excessive or exorbitant is for a court of law to decide in case a dispute concerning interest is brought before it. There are cases where interest rates of 3% per month and higher have been decided as excessive and have been reduced.

A promissory note may be signed by more than one maker. The makers who will sign the promissory note, except those who are signing in a representative capacity (meaning they are signing on behalf of a maker), are liable to pay the amount of money stated in the promissory note.

If a representative will sign on behalf of a maker, the name of the representative should be indicated in the Promissory Note with the name of the maker disclosed thereon otherwise such representative will pay in his personal capacity (or with his own money). If the representative will also sign the promissory note as a maker, he should sign twice to show both of his capacities as a representative and a maker.

The liability of multiple makers can either be joint or solidary.

The liability is joint if the makers will each be liable for a portion of the amount on the promissory note. This means that the payee cannot demand more than the portion that they are liable for.

The liability is solidary if each maker can be made liable to pay the entire amount on the promissory note. If one maker pays the entire amount, the maker who paid can ask for payment from the other makers.

Example: A, B, and C sign a promissory note for P15,000.00 to be paid as follows: A will pay P10,000.00, B will pay P3,500.00 and C will pay P1,500.00. If the liability is joint, the payee can only collect the amounts as stated above from each maker. However, if the liability is solidary, the payee can collect the whole amount of P15,000.00 from either A, or B, or C.

A negotiable promissory note means that the payee can transfer the note (by indorsement) to another person and the maker will have to pay the amount on the note to the transferee. The indorsement must be written on the promissory note or on a paper attached thereto. The signature of the payee who made the indorsement, without any other words, is a sufficient indorsement. The indorsement is completed by delivery or when it is handed to the transferee.

Example: A made a promissory note to pay B, P10,000.00. If the note is negotiable, B can indorse the note to C by signing the note and delivering it to C. Once indorsed, A will now have to pay C the P10,000.00. If the note is not negotiable, B cannot transfer the note by indorsement to any other person.

If there will be payment of installments, the Promissory Note subsists so long as installment payments are still due. If there will be no payment of installments and interest (lump-sum payment), the amount should be fully paid before the due date (the date on which the amount should be paid) provided under the Promissory Note.

Note that so long as the amount in the Promissory Note is not fully paid, the obligation to pay under the Promissory Note still applies.

Once the Promissory Note is completed, one original copy of the same should be printed, all the makers should sign the promissory note. Only those who signed the promissory note as makers shall be liable to pay the principal amount. After signing the Promissory Note, it has to be delivered to the payee.

If the Promissory Note is negotiable, it can be indorsed by the payee to another person called the transferee. The transferee can then use the Promissory Note and demand payment from the maker when the Promissory Note becomes due.

Note that the nature of a Promissory Note is that it is a mode of payment. For that reason, there should only be one original Promissory Note signed by the maker, delivered to the payee, or indorsed to a transferee.

The law on obligations and contracts is generally governed by the Civil Code of the Philippines. If the instrument is negotiable, the Negotiable Instruments Law (Act No. 2031) applies.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter?

Promissory Note - sample template online - Word and PDF

Country: Philippines