24/11/2025

24/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

24/11/2025

24/11/2025

Word and PDF

Word and PDF

2 to 3 pages

2 to 3 pages

A redundancy notice is used by an employer to notify an employee of their final selection for dismissal by reason of compulsory redundancy. The redundancy notice can be used by an employer that is based in Great Britain (England, Wales and Scotland).

An employee dismissal letter is used by an employer to dismiss an employee on the grounds of poor conduct, poor performance or gross misconduct. Usually, an employee dismissal letter will be sent following the conclusion of a formal disciplinary process.

A redundancy notice will be used when an employee is being dismissed by reason of redundancy. Redundancy occurs when an employer needs to reduce the size of its workforce.

No. It is not strictly mandatory to provide notice of redundancy in writing. Notice of redundancy can be provided verbally. However, it is best practice to provide notice of redundancy in writing. This way, both parties have a written record of this, and all the important information about the terms of the dismissal can be set out in writing.

In an employment setting, redundancy means the need for the employer to reduce the size of its workforce. The need for redundancy will arise where:

A collective redundancy situation means that 20 or more employees are going to be made redundant within any 90-day period. In a collective redundancy situation, an employer must follow a specific process which will include:

There are certain situations where a redundancy will automatically unfair, meaning that an employee may have grounds to bring a claim in the Employment Tribunal. A redundancy notice will be automatically unfair if an employee has been selected for redundancy because:

An employer should also ensure:

An employer must ensure that it follows the correct redundancy process. Usually, an employer will hold a policy document which sets out the process.

In the case of a collective redundancy situation (where 20 or more redundancies are being made within a 90-day period), the employer must follow the correct process before making any final dismissals. This will involve a collective consultation with employees and their representatives. An employer must also notify the government Redundancy Payments Service in the case of a collective redundancy situation.

All employees should be individually consulted during a meeting, at least once, in any redundancy situation.

A redundancy notice will be sent by an employer who has employed staff members under a contract of employment.

Once finalised, the redundancy notice should be signed by the employer. Usually, a letter of this nature will be handed to an employee in person during a meeting.

The employee will then be required to work until their notice period* unless:

An employee's notice period is the amount of time an employee has to work for their employer after they resign or after the employer terminates the contract of employment.

There are different types of redundancy pay:

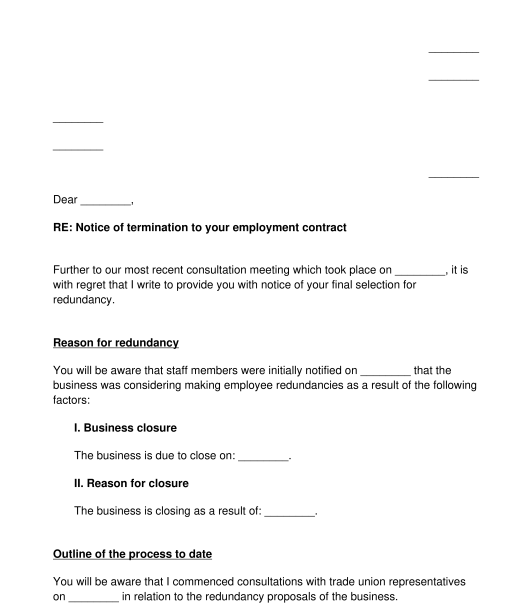

A redundancy notice should provide the following information to an employee:

The key pieces of applicable legislation concerning redundancy are:

The Advisory, Conciliation and Arbitration Service (ACAS) also provides guidelines and advice to employers in respect of redundancy.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Redundancy Notice - Sample, template - Word & PDF

Country: United Kingdom