11/25/2025

11/25/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

11/25/2025

11/25/2025

Word and PDF

Word and PDF

9 to 13 pages

9 to 13 pages

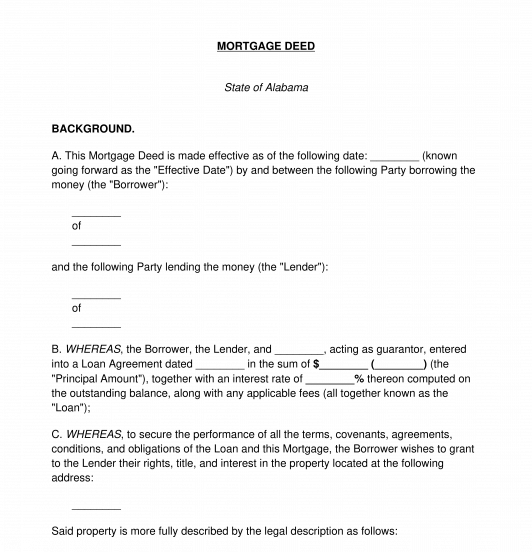

A Mortgage Deed, also known as a Mortgage Agreement, is a document where a borrower of money grants the lender of that money conditional ownership in a property as a security interest against the loan until the loan is paid in full. If the borrower fails to repay the money as agreed, the lender then becomes the owner of the property used as security and will have the power to sell it to recoup the costs of the unpaid loan. This document is separate from a Secured Promissory Note or Loan Agreement, which creates the actual loan and more fully sets out the terms and conditions of the loan itself.

Mortgage Deeds are most commonly used to secure a loan taken out by the borrower to purchase a piece of property or home. The purchase of a property or home is often a big investment that involves a substantial amount of money. Lenders will want added security before loaning large sums of money to ensure that they will recoup their investment. A Mortgage Deed allows them to take possession and sell the property if the Borrower stops making loan payments. It also gives buyers the ability to borrow large sums of money and provides an incentive to make payments on the loan or risk losing their property. A Mortgage Deed is used specifically to put up a piece of real property, like land or a home, as security. To use personal items, such as jewelry or a car, to secure a loan, use a Security Agreement instead.

A Mortgage Deed is very similar to a Deed of Trust, but the two documents operate differently to serve similar purposes. A Mortgage Deed and a Deed of Trust both create a lien on a property to secure repayment of a loan. However, a Mortgage Deed is only between two parties – the Borrower and the Lender – whereas a Deed of Trust is between three parties – the Borrower, the Lender, and the Trustee. In a Deed of Trust, the Trustee holds the title to the property in trust for the Lender. A Deed of Trust also allows the Trustee to initiate a foreclosure sale on the property without a court order if the Borrower is in default on the loan – also called the "power of sale". In contrast, the Lender under a Mortgage Deed would have to initiate foreclosure proceedings through the courts unless the borrower agrees to grant them the power of sale in the Mortgage Deed.

How to use this document

This document contains all of the information necessary to use a piece of real property as security or collateral for a loan. The Mortgage Deed includes all of the important information, such as:

Once the Mortgage Deed is completed, the borrower must sign and date it in front of a notary and have the document notarized. A notary page is included at the end of the document. After the Mortgage Deed is signed and notarized, it needs to be recorded in the county where the property is located. Often a small fee must be paid at the time of filing. The county will keep the original copy of the Deed, but the Parties should keep a copy of the Deed in a safe and secure location for their records and in case of future dispute.

Applicable law

Mortgage Deeds are governed by state law. Different states have different requirements for when and how the Deed should be filed. Contact the local county Register of Deeds to get information about which governmental agency should be given the Deed to file and record before being returned to the parties.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Mortgage Deed - FREE - Sample, template - Word and PDF

Country: United States