25/11/2025

25/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

25/11/2025

25/11/2025

Word and PDF

Word and PDF

1 page

1 page

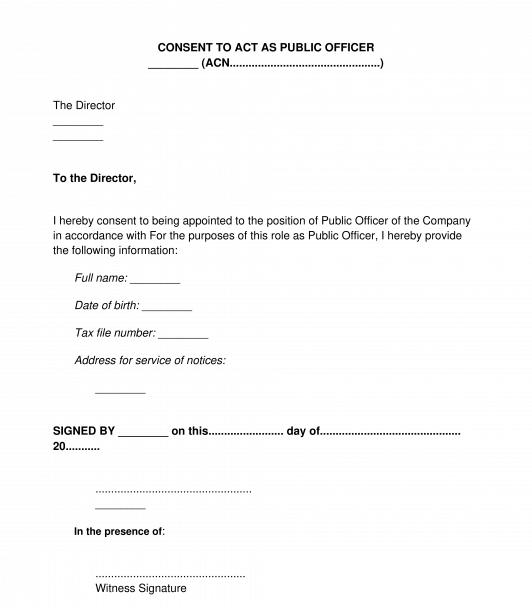

This Consent to Act as Public Officer can be used when a person is appointed as the public officer for a company. When a person becomes public officer for a company, they take on various legal responsibilities. The company may, once it has prepared this document, keep a signed copy of the document as a record of the public officer's consent to act in this role (and to accept these responsibilities). This document also allows the company to obtain vital personal details from the public officer.

A public officer is a company's official point of contact for matters involving the Australian Taxation Office. Section 252 of the Income Tax Assessment Act 1936 (Commonwealth) requires a company to appoint a person to the position of public officer within three months of the company commencing business or deriving income in Australia.

A person must meet certain criteria in order to be eligible for the role of public officer. In particular, the public officer must be:

- at least 18 years old; and

- ordinarily a resident of Australia; and

- capable of understanding the nature of their role as public officer.

Once appointed, the public officer also incurs some important legal responsibilities. Further information about public officers is available from the Australian Taxation Office.

How to use this document

Firstly, it is important to check the company's constitution and Shareholders Agreement (if applicable) to determine who can appoint a public officer, and any procedures that must be followed. In many companies, a public officer may be appointed by Directors' Resolution.

Once the company has followed any appropriate procedures in order to appoint the public officer, this document can be used to record the public officer's details as well as his or her consent to act in this role.

A copy of the signed consent can be provided to the public officer. The company may keep the original signed consent with the company's records.

The company then also needs to contact the Australian Taxation Office to notify it of the appointment of the public officer.

Applicable law

Company matters are generally dealt with under the Corporations Act 2001 (Commonwealth).

Australia has the Income Tax Assessment Act 1936 (Commonwealth) and the Income Tax Assessment Act 1997 (Commonwealth), both of which apply to income tax matters in Australia. Matters specifically relating to the public officer are dealt with under section 252 of the Income Tax Assessment Act 1936 (Commonwealth).

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Consent to Act as Public Officer - sample template

Country: Australia