21/10/2025

21/10/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

21/10/2025

21/10/2025

Word and PDF

Word and PDF

1 page

1 page

This Letter to Claim from Car Insurance can be sent to an insurance provider in order to request coverage for any vehicle related claim. This might relate to theft or damage to the vehicle, claims for repairs or a replacement, rental car costs or other transport costs (such as taxis or Uber, while the vehicle is out of action), medical costs, or any other matters which the vehicle insurance policy might cover.

Please note that for medical expenses, we also have a Letter to Claim from Medical Insurance available. In the event that a crash occurred while on holidays, we also have a Letter to Claim from Travel Insurance which may be used to claim from a travel insurance company. If a claim has already been submitted, and the insurer has made an offer, but the policyholder wants to reject that offer, then we also have a Letter to Reject Car Insurer's Offer available.

How to use this document

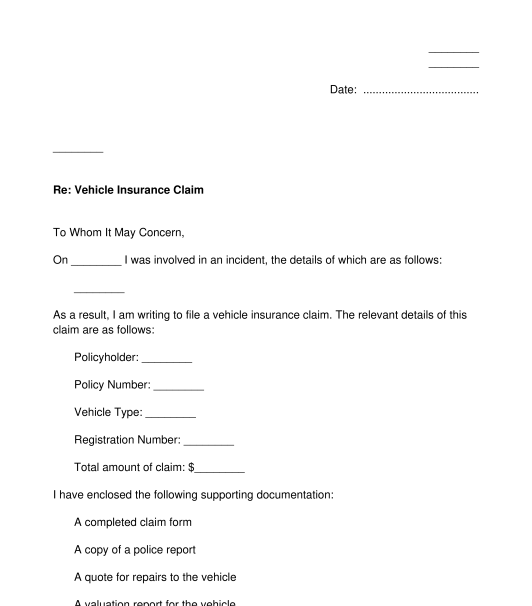

This letter includes all of the relevant information that an insurer is likely to need in order to process a claim, such as the name of the policyholder, the details of the incident, the date(s) of the incident, and the amount of the claim. There are also additional documents that can be enclosed with this letter, such as a police report, quotes or receipts. The insurer might also have their own claim form that must be completed. If this is the case, the insurer's claim form may be filled out and sent in along with this letter.

Once this letter is done, it may be downloaded, signed and sent by registered post so that the sender has a record that the letter was received by the insurer. The sender of this letter should also keep a copy of the letter, in case of future dispute.

Applicable Law

There are no laws that specifically dictate what must be contained in a Letter to Claim from Car Insurance. However, if a person is deliberately dishonest in an insurance claim, this is likely to constitute fraud, which is a crime under the criminal laws of each state and territory.

In the event that several parties are involved in a vehicle crash, and one party is at fault, then an aggrieved party may consider taking action in negligence. In addition, each state and territory has some form of a no-fault motor vehicle accident compensation scheme. Further information is available from the Australian Treasury.

Regarding the contract of insurance between the insured person and the insurer, general principles of contract law, as provided by the common law, may be relevant. If the sender is unsure whether certain items are covered by their insurance policy, they may need to check their policy documents.

The insurer may also require particular information to be included in order for a claim to be processed and approved. Before sending this letter, the individual making the claim may check their policy documents, the insurer's website or help hotline service to be sure this letter includes all of the necessary information.

If in doubt, seek legal advice.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter

Letter to Claim from Vehicle Insurance - template

Country: Australia