22/11/2025

22/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

22/11/2025

22/11/2025

Word and PDF

Word and PDF

1 page

1 page

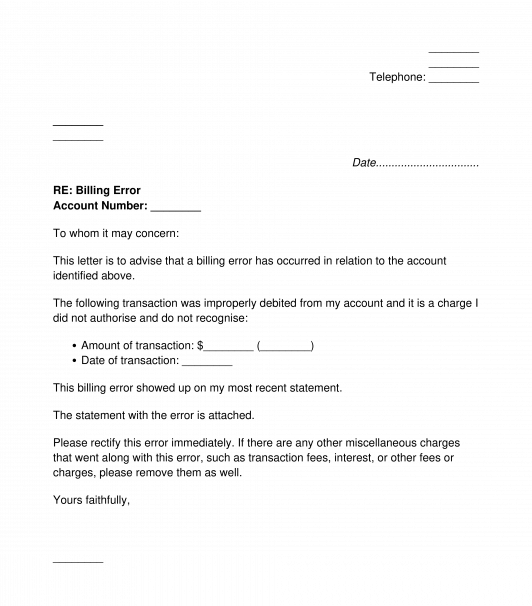

This is a letter asking a company or organisation to correct a billing error. The primary purpose of this letter is to give the company the information they need about how the billing error came to be so that they may correct it. Often, a company may not even know about small errors in consumer accounts and therefore, a formal letter is needed to bring it to their attention.

Sometimes, billing errors are first brought to a company through a telephone call. It is not a bad idea to make such a call, however, it is still very important to put a formal request for a billing error to be corrected in writing in order to keep everything documented and avoid disputes later on.

This letter can be used for any situation in which a billing error needs to be corrected. It does not matter whether the letter is being directed at a credit card company or another consumer company, such as a store or lender associated with a store.

How to use this document

In this letter, the sender will enter pertinent details about each of the parties. There is a space for the sender's name and address, as well as email (if desired) and phone number, so that the company may reach the sender easily. There is also a space for the contact information of the company, and optional spaces for a name and title of an individual person, if the sender knows of a specific person of whom to send the letter.

The most important portion of the letter covers information about the billing error, such as the amount, date, transaction ID, whether it was an improper credit or debit and how the sender first came to find out about the error.

While it may not be necessary to provide any attached documentation (such as a copy of a bank statement revealing the error), it is good practice to provide any such supporting documentation, as this can lead to a quicker resolution. The company may request additional information after the letter is received.

After this letter is filled out, print it, sign it, and send it to the relevant organisation.

Applicable law

The National Consumer Credit Protection Act 2009 (Cth), and in particular the National Credit Code, which appears in schedule 1 of that Act, deals with consumer credit in Australia.

Further information and guidance can also be obtained from the Australian Securities and Investments Commission ("ASIC") and from ASIC's Moneysmart website.

How to modify the templateYou fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter

Letter to Correct Billing Error - sample template

Country: Australia